Global plugin vehicle registrations were up 114% in August 2021 compared to August 2020, scoring 516,000 units (or 7.7% share of the overall auto market). That made it the plugin market’s third best month ever, and expect September to be another record month.

Fully electric vehicles (BEVs) represented 71% of plugin registrations in August, slightly above the year-to-date tally (67%). In total, there were some 365,000 registrations of BEVs, or 5.4% share of the overall auto market.

With the YTD tally now above 3.5 million units (and at a record 6.6% share), and knowing that the last months of the year are traditionally strong sellers, we should be seeing the plugin vehicle (PEV) market easily surpass 6 million units this year, with the 7 million unit mark now a possibility of being achieved!

For comparison sake, 2020 ended with 3.1 million units registered. Not bad, considering the current chip shortage, eh?

While disruption is already happening in Europe and China, we should only see consistent disruptive levels on a global scale next year, which will get a boost from the US market as it goes into warp speed due to new incentives and the start of the ramp up of several electric pickup trucks.

Having said that, December should be the first month with double digits on a global level (and the first to break one million units?), as all 3 major markets (China, Europe, and USA) are expected to have record months.

The future will depend much on the development of the COVID pandemic, the economic recovery, and the chip (and battery) shortage, but whatever happens, expect plugins to continue increasing market share, as many legacy OEMs are now prioritising their plugin offerings over their fossil fuel models, because they know need to have a foot in the door in the fast-growing plugin market now in order to assure survival in a future BEV-based automotive market.

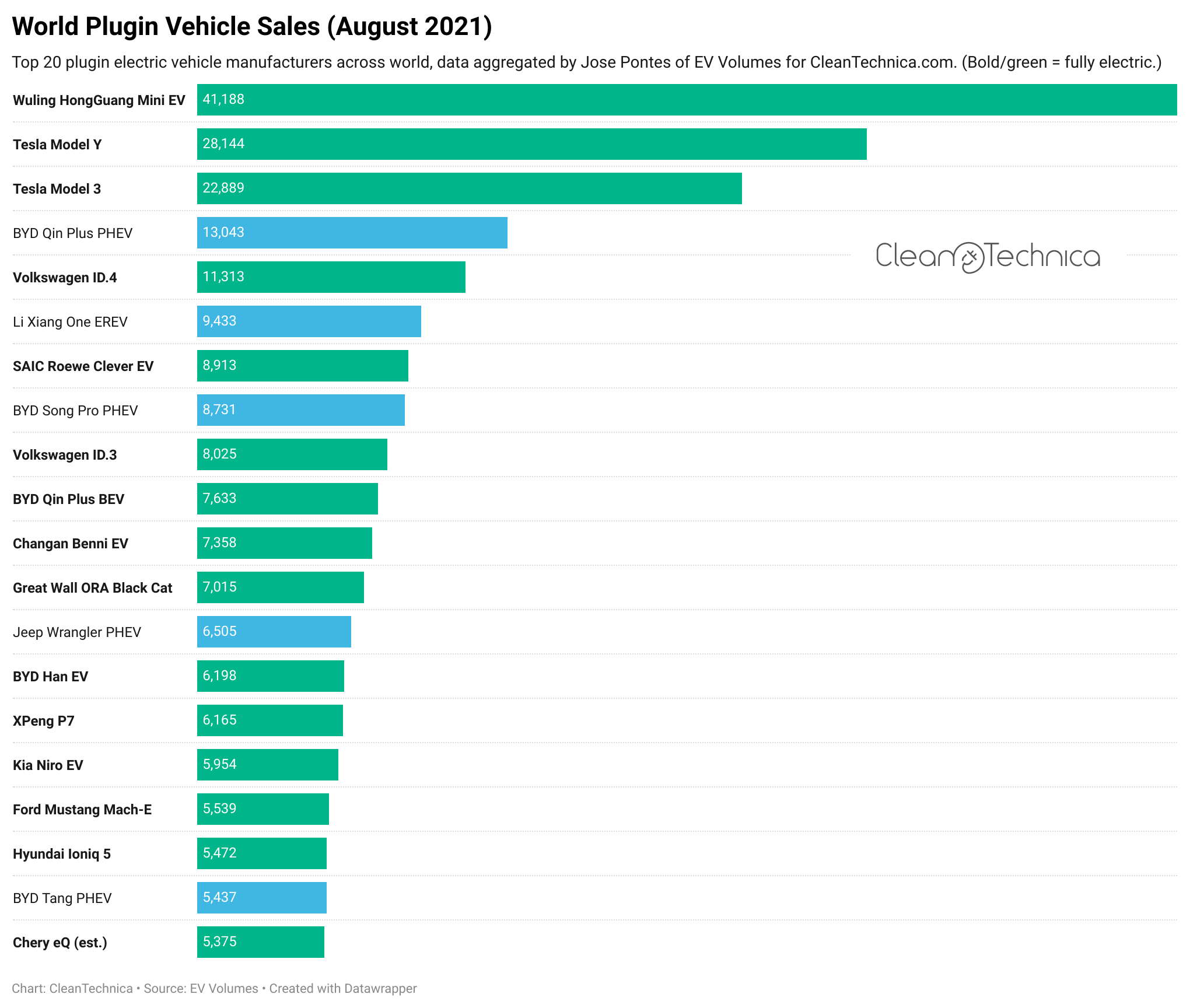

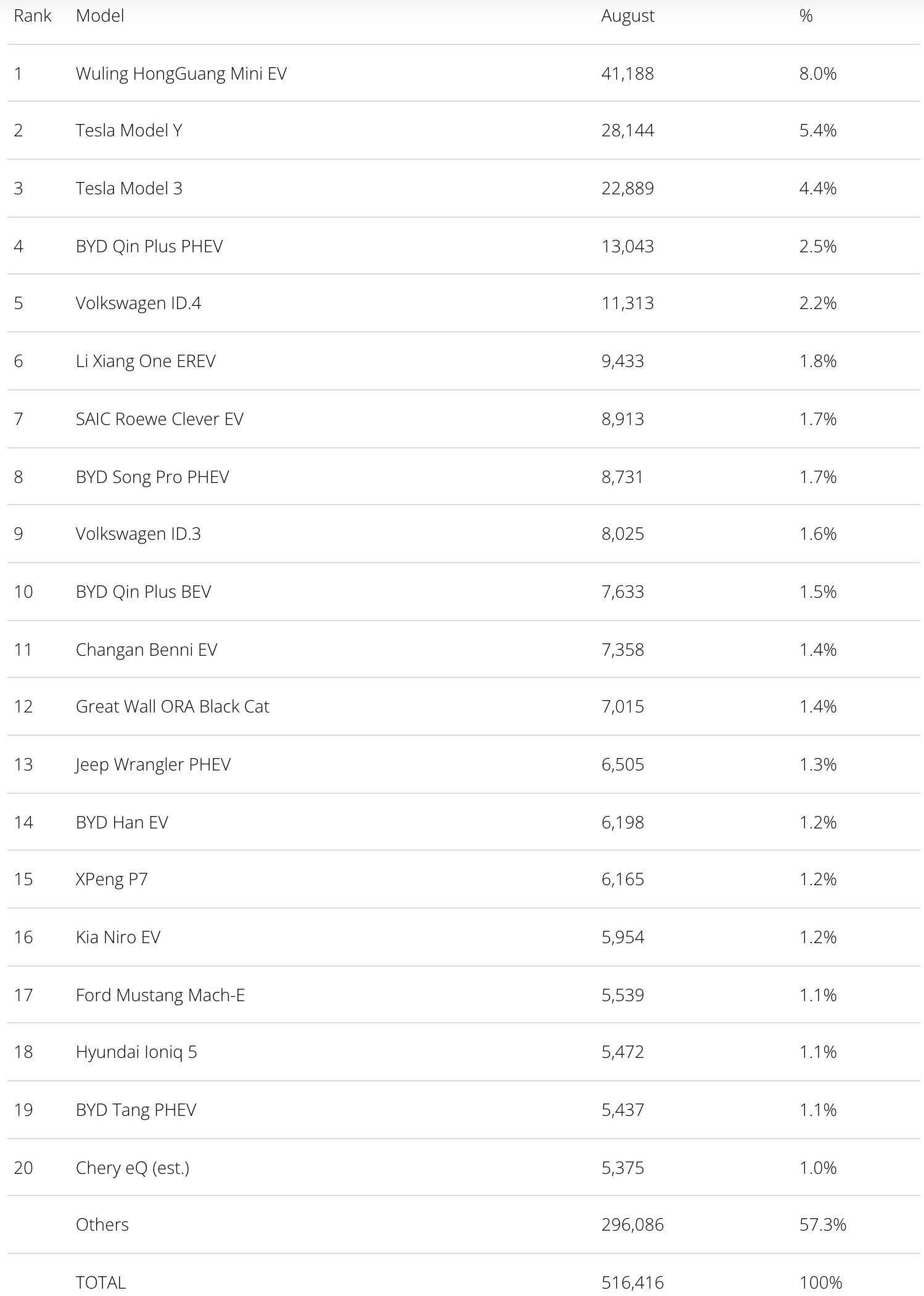

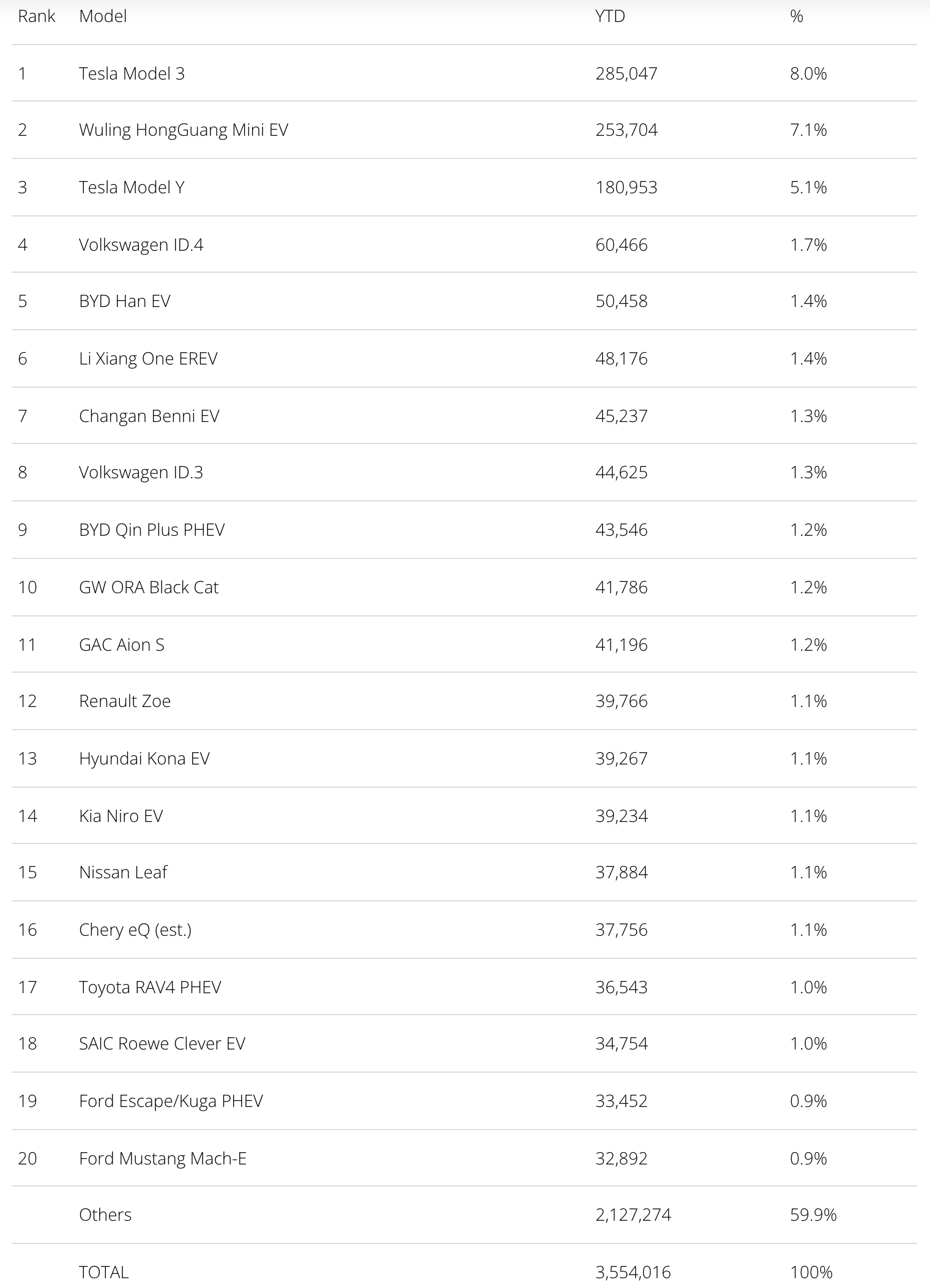

In the model ranking, it should be noted that the Wuling Mini EV won the Best Seller award for the 2nd straight month, the first time the small 4-seater repeated a monthly #1 ranking. That was thanks to a record 41,188 registrations. It also got its first best seller title in the overall Chinese auto market in August, the icing on the cake.

The #2 Tesla Model Y beat the #3 Model 3 by more than 5,000 units, with the sedan experiencing its second straight drop in YoY deliveries in August.

Off the podium, the Volkswagen ID.4 was beaten by the surging BYD Qin Plus PHEV, which scored a record 13,043 registrations, and with the BEV version of the midsize Chinese model also ramping up (it was #10, with a record 7,633 units), both versions counted together got an amazing total of 20,676 registrations. One wonders where and when the delivery ramp up will end. Will the BYD midsizer be the first to run head to head with the Model 3?

Elsewhere, a mention goes out to several Chinese models hitting record scores — there were 12 Chinese models in August’s top 20, 7 of them with record scores. Besides the aforementioned Wuling Mini EV, BYD Qin Plus PHEV and BYD Qin Plus BEV, the #6 Li Xiang One, #7 SAIC Clever EV, #8 BYD Song Pro PHEV, and #15 XPeng P7 all hit record scores.

In the traditional OEM camp, the highlight was the #9 Volkswagen ID.3, which scored its best result in 2021, with 8,025 registrations, while the recent #17 Ford Mustang Mach-E and #18 Hyundai Ioniq 5 continued to shine. The #13 Jeep Wrangler PHEV continues to impress as well and was the only PHEV from a legacy OEM to feature in this top 20. It seems Stellantis has struck gold with the PHEV version of the charismatic model, which makes the rumoured Magneto BEV version of the Wrangler a real no-brainer.

Outside the top 20, we should mention a couple of Chinese EVs, which are either in production ramp up, like Hozon’s Neta V (4,611 units) or the Leap Motor T03 (4,409), or recovering their mojo, like the BYD Yuan EV (4,784 units). Expect to see them in the top 20 soon.

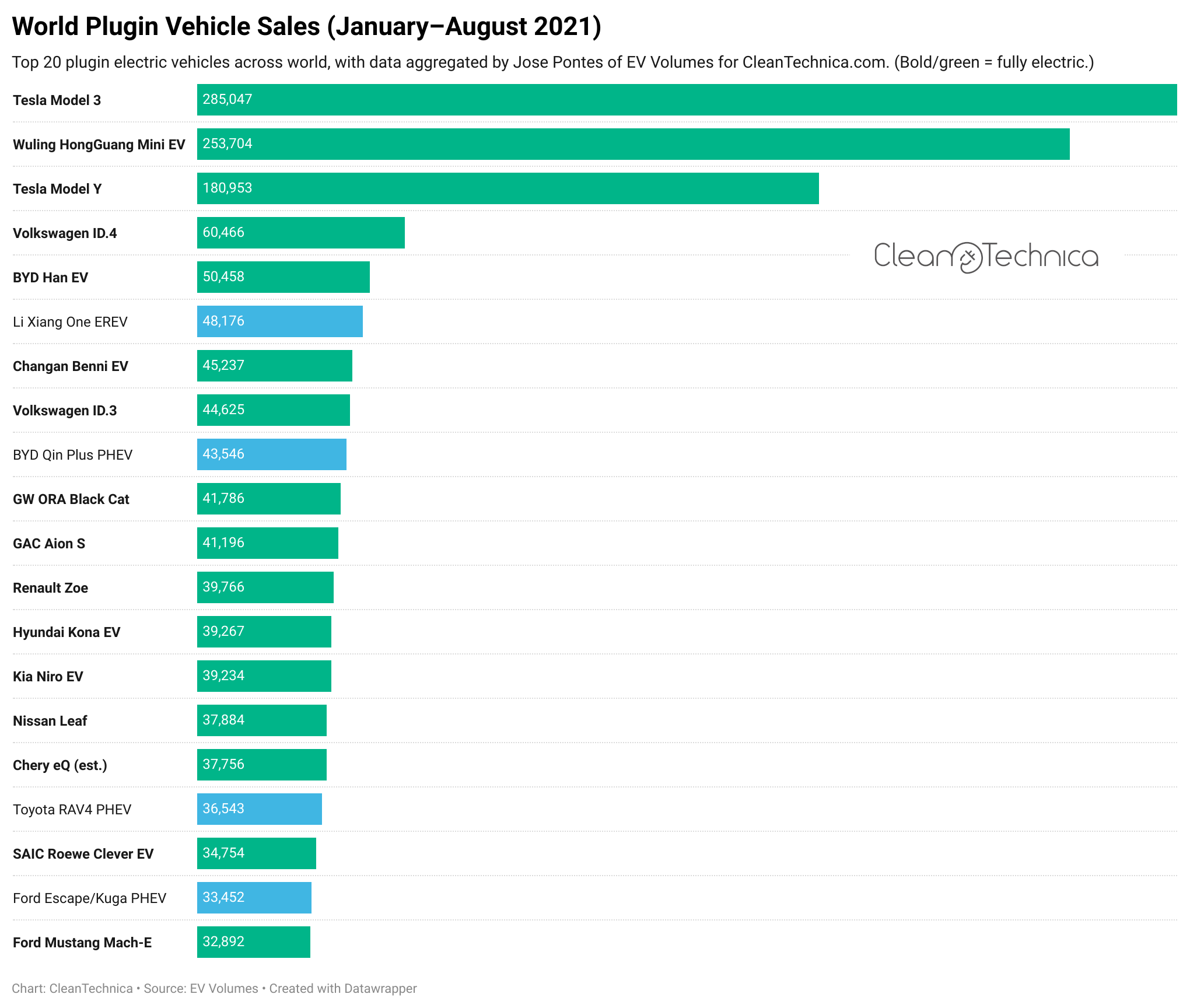

In the YTD table, the climber of the month was the BYD Qin Plus PHEV, which jumped 8 spots to #9, with the BYD midsizer set to soon run alongside the full-size Li Xiang One yacht SUV for the #5 spot.

There are several success stories to be told about the current moment in the Chinese EV industry, from the unexpected success of the Wuling Mini EV, to the recent BYD battery-derived surge, but for me the most striking story is Li Auto, the maker of the Li Xiang One. It had everything in place to not go well: It wasn’t a media-friendly EV startup (and we all know how much brand-building is important there), its only model was an expensive and large SUV, and Chinese brands were known to struggle in the higher ends of the market, and to worsen things, it was using a technology (EREV) that others had already abandoned (GM, BMW) and was thought to be outdated.

And yet, here we are, the Li Xiang is on its way to becoming the Best Selling full-size model in the plugin market *, and will be the model to beat next year. So, a message to Tesla, Lucid, Mercedes, Audi, BMW: This little known Chinese model is the category kingpin. You have to beat it if you want to reach gold in the full-size category.

- Although, if we were to add the BEV and PHEV versions of the BYD Han together, the big sedan would continue to be the full-size category best seller. And what do you know, the two leaders in the higher end of the PEV game are Chinese.

Elsewhere, Great Wall’s ORA Black Cat climbed to #10 thanks to a decent August performance, while another small Chinese EV, SAIC’s Roewe Clever EV, joined the table in #18, highlighting the current popularity of city EVs in China (“You’re welcome,” says Wuling).

Speaking of new faces, Ford’s new BEV baby, the Mustang Mach-E, joined the table in #20, thus resulting in two Fords in the top 20. The American brand became the 4th automaker to have more than one model in the top 20, with the others being Tesla (Model Y and Model 3), Volkswagen (ID.3 and ID.4), and BYD (Han EV and Qin Plus PHEV). Not bad company.

Outside the top 20, we should mention the rising XPeng P7, which is some 1,000 units below the top 20 and should join the table soon, which would make it 10(!) Chinese models in the YTD top 20.

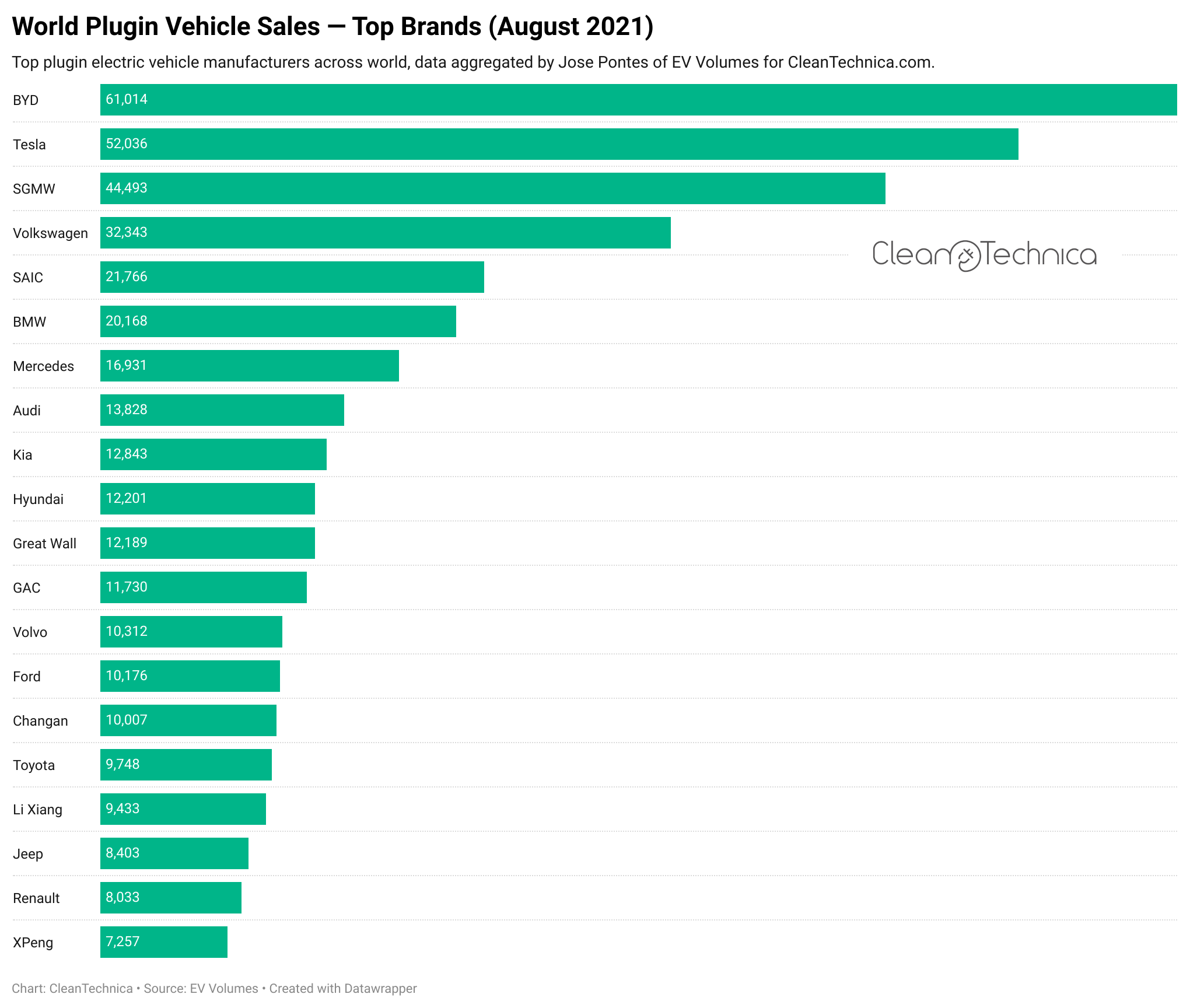

BYD Wins (again) the Manufacturer Competition

BYD is going from strength to strength, once again beating its own record, with 61,014 registrations (+334% YoY!) in August. That allowed it to beat Tesla in the monthly race for the 2nd time in a row. With the seemingly never-ending record streak from the Shenzhen automaker set to continue, it might even give Tesla some fight in the race for the Q3 title.

#3 SGMW also set a record in August, mostly due to the strong performance of the Wuling Mini EV, which added to a strong result from parent company SAIC (#5, with 21,766 registrations). That made Shanghai Auto one of the winners of the month.

Toyota impressed in August, with 9,748 registrations (+191% YoY), mostly thanks to the RAV4 PHEV. But the biggest surprises were Li Xiang in #17, with a record 9,433 registrations, and #18 Jeep — thanks to the Wrangler PHEV’s success, it has become Stellantis’ next big thing. Will the upcoming Grand Cherokee PHEV help it to consolidate a top 20 position and Best Selling Stellantis brand status?

Also worthy of mention is the fact that XPeng made it into the top 20. Renault was only #19 … with Nissan nowhere to be found.

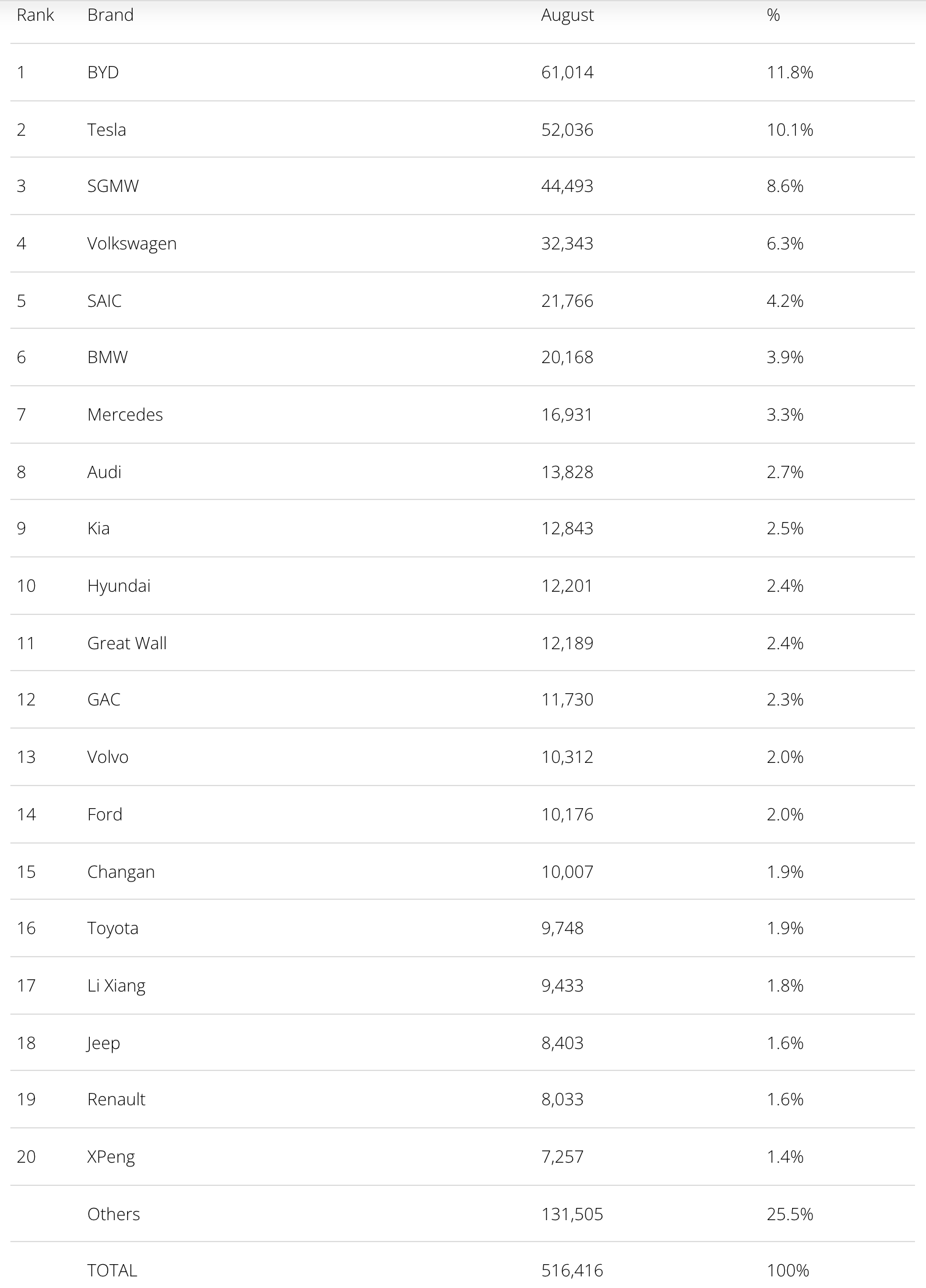

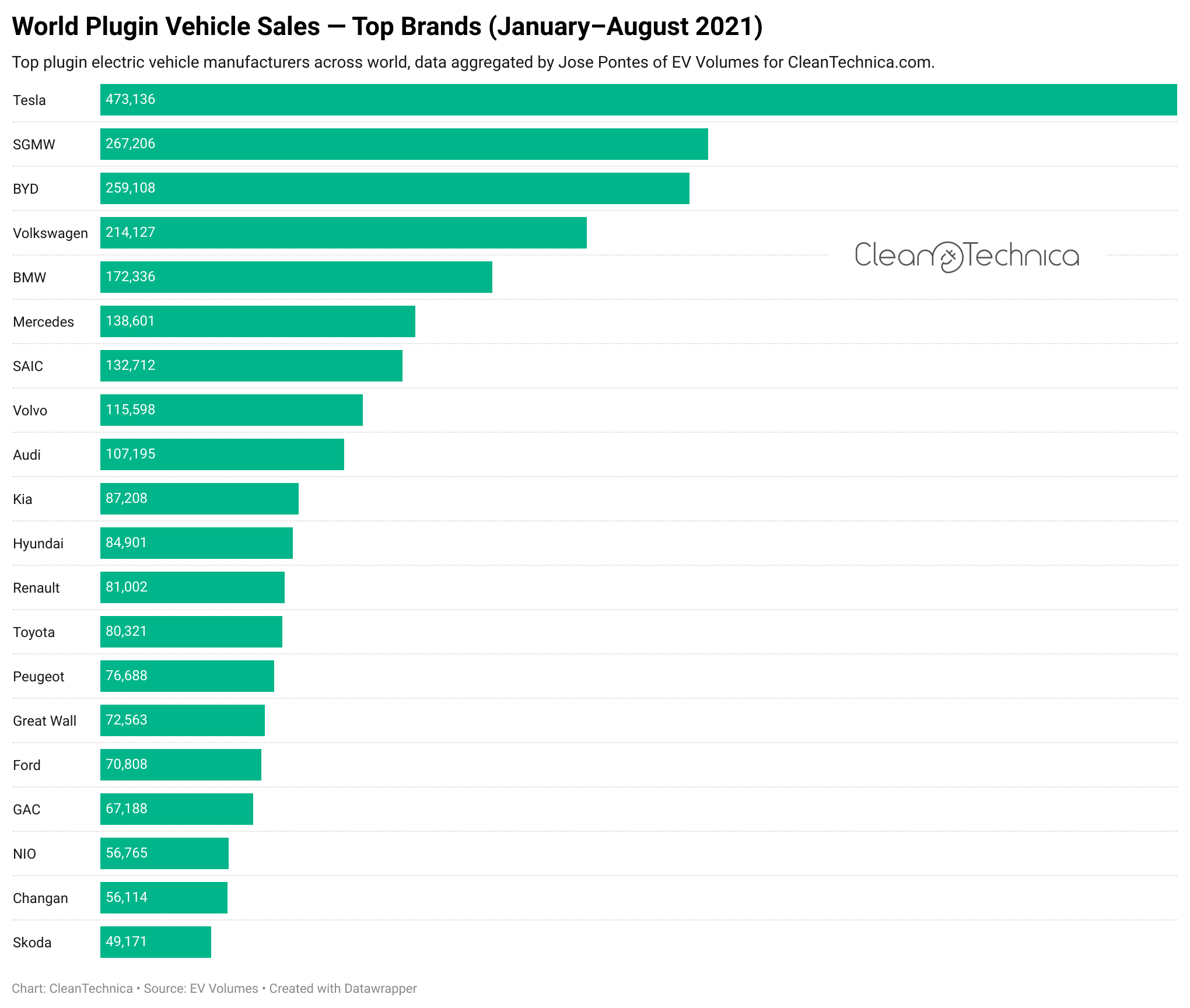

In the YTD table, a rising BYD has distanced itself from #4 Volkswagen and is now closing in on silver medalist SGMW, which is only 8,000 units ahead. Expect BYD to surpass it next month.

Hyundai had reasons to smile, with the Korean automaker benefiting from Renault’s slow month to climb to #11, while #13 Toyota is now less than 700 units behind the French automaker. So, there might be more position changes here in September.

The remaining position change came from Great Wall, now in #15, thanks to a strong performance from its small Black Cat.

Elsewhere, #19 Changan is some 600 units behind #18 NIO, with the startup brand’s recent performances not matching expectations (chip shortage?) and risking its top 20 presence in the medium term, as there are several automakers ramping up just outside the top 20, like #21 Li Xiang (48.2K units), #22 Jeep (48K), and #23 XPeng (46.3K).

By OEM, Tesla leads, with 13% share, down 5% YoY, followed by SAIC (12%) and Volkswagen Group (11%).

Now, before Tesla bulls and Tesla shorters go at each others’ necks regarding Tesla’s share, I should point out that while it’s true that Tesla has lost significant market share — that is natural, and doesn’t mean that the maker is going down. As the plugin market matures, it is only natural that market leaders will see their shares eroded and the market will become more balanced.

In fact, of all top 20 brands in the YTD table, only two have actually gained share YoY, one being SGMW, because 12 months ago the Wuling Mini craze was just getting started, and the other being BYD, which won a mammoth 1 percentage point share, from 6% in August 2020 to 7% today.

Most brands have lost share in these past 12 months, in some cases dramatically, like Renault, which now has half the share (2%) it had a year ago. Others are just happy to keep the share they had last year, like the case of #4 Volkswagen, #6 Mercedes, #13 Toyota, and #16 Ford.

Now, will these positions remain the same once the EV transition is fully consolidated? I don’t know, but with the competition in the New EV Order being fiercer than the Old ICE Order (besides EV startups, one has also to take in account the rise of the Chinese regular-carmakers-turned-into-exporting-EV-brands), one has to wonder about the fate of several OEMs (Honda, Mazda, Jaguar Land Rover, Suzuki, etc.) and the future relevance of others (Toyota, Renault-Nissan, General Motors).

Appreciate CleanTechnica’s originality? Consider becoming a CleanTechnica Member, Supporter, Technician, or Ambassador — or a patron on Patreon.