(Oxford Analytica) — Shortages of critical components, shipping disruptions and rising production costs are limiting the ability of automotive manufacturers to keep pace with consumer demand. This is pushing up prices, and accelerating changes in product lines, corporate structures and supply chains. Meanwhile, major vehicle and parts manufacturers are investing heavily in new product and process development to focus on electric vehicles (EVs) and meet targets for future carbon emission reductions.

What next

Global automotive production is unlikely to recover to pre-pandemic levels until 2023. Smaller parts manufacturers are being squeezed by rising costs and competitive price pressures, undermining their capacity to invest in new processes and raising closure risks. In parallel, the shift to zero-emission vehicles is accelerating, driving investments across EV and battery value-chains, shrinking supply-chain geographies and setting the stage for a far-reaching contraction of the parts industry that depends on traditional vehicle production.

Subsidiary Impacts

· Parts shortages and higher costs are prompting automakers to prioritize higher-margin models in order to capitalize on pricing leverage.

· The demise of traditional auto manufacturing will threaten jobs, lead to factory closures and make EV output a polarizing political issue.

· US-China tensions will plague EV output: China has 25 times more large battery manufacturing plants than the United States.

· As demand for low-skilled roles falls and demand for high-skilled roles such as automation specialists rises, re-skilling will be key.

Analysis

Global automotive sales and production were weakening before the pandemic. Production levels grew from 77 million vehicles in 2010 to 97 million in 2018, but fell to 92 million vehicles in 2019. Global automotive sales plummeted by 15% to 77.2 million units and production fell by 16% to 74.5 million vehicles in 2020 as the COVID-19 pandemic hit demand and supply worldwide.

In 2020, car sales fell by 6% in China, 15% in the United States and 24% in Europe. China, which accounts for 21% of global automotive production, saw output levels drop by 4% to 24.3 million vehicles. Automotive production fell by 15% to 14.5 million vehicles in the United States, by 21% to 16.4 million vehicles in Europe and by 20% to 21.8 million vehicles in the rest of the world.

Global demand has rebounded strongly since May 2020. Market surveys indicate that the pandemic has had only a marginal impact on consumer preferences, shifting demand slightly towards smaller and less expensive vehicles rather than undermining overall purchasing expectations.

Automotive manufacturing has failed to keep pace. The price of new and used vehicles have risen sharply as manufacturers have run down inventories without catching up with consumer demand. Production has been held back by supply chain disruptions, caused by:

· temporary shutdowns and financial vulnerability among parts suppliers;

· shortages of critical components; and

· international shipping and logistics constraints.

Shortages of semi-conductors and other electronic components have hit the automotive sector especially hard as they account for around 35% of vehicle costs.

To try to compete, assembly plants have tried to limit price increases by their suppliers, compressing profit margins particularly for smaller parts producers down the supply chain, which in turn has limited those firms’ ability to invest, increase capacity or guarantee supply. Assemblers have also favored the production of higher-margin vehicles, on which they have been able to raise retail prices more easily.

In parallel, they have been diversifying their sources of supply, building more internal capacity (including production of customized chips), consolidating their dealerships and looking for other ways to reduce costs in their operations and supply chains.

Slow growth through 2023

Earlier this year most analysts were predicting a strong recovery in auto production and sales as supply chain disruptions diminished. At the end of June, the market consensus was that global vehicle sales would rebound by 8-10% to between 83 million and 85 million units in 2021. Sales were expected to increase by 14.5% in the United States, 9.8% in Europe, 6.9% in China, and 6.8% in the rest of the world.

Global production was forecast to grow by 12-14% this year. The market was then expected to cool in 2022 with sales growing by 3-5% and output by 6-8%.

These predictions are likely to prove over-optimistic.

Chip makers are investing in new production capacity in an effort to keep up with customer demand, but the auto industry is not the only sector facing supply shortages. Automotive companies are competing with electronics, appliance, equipment and technology manufacturers, many of which have established relationships with chip producers, make larger orders and are better able to bid for supply at higher prices.

Moreover, it takes time to ramp up chip fabrication and the manufacturing of other auto parts after a period of production slowdowns. Even the most automated production systems require companies to source and train a qualified workforce.

Like auto assemblers, chip makers and other parts producers have focused on higher-margin products through the pandemic, leaving start-ups and smaller companies to step in and fill supply gaps. Auto companies themselves are now opening chip fabrication plants or acquiring smaller chip makers to meet demand.

As manufacturers try to reduce their exposure to price corrections once supply comes on stream, automotive supply chains will remain at under-capacity levels and vulnerable to market shocks throughout the year ahead.

As a result, worldwide vehicle sales and production are more likely to increase by 4-6% this year, with stronger growth in 2022. A full recovery to pre-pandemic levels is not likely before 2023. Long-term projections are still for the global automotive industry to grow to just under USD9tn by 2030.

EVs will lead the way

Despite the market disruptions, all major auto makers are continuing to invest heavily in EV development and production. Worldwide EV investment is expected to increase by more than USD400bn between 2020 and 2025.

Investments in hydrogen-powered technologies are also increasing but are unlikely to become a mainstream option for light vehicle propulsion this decade.

|

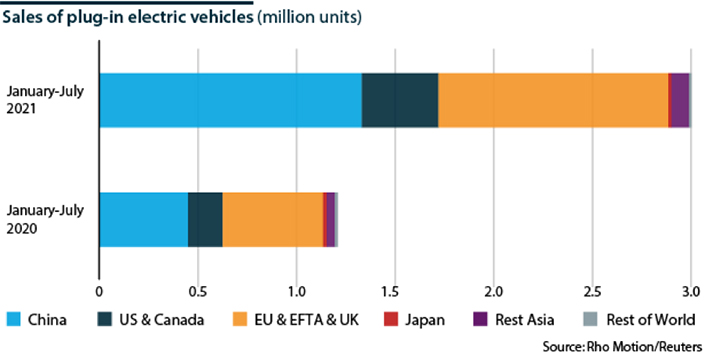

EV investments are driven in part by consumer demand. While EVs currently account for only 10 million vehicles or 1% of the global fleet, they are expected to account for 4-6% of global sales in 2021 and around 8% in 2022, with demand especially strong in Europe and China. Demand is even stronger when hybrid vehicles are included. Market forecasts suggest that EVs will account for almost 11% of global sales by 2025 and between 29% and 50% by 2030.

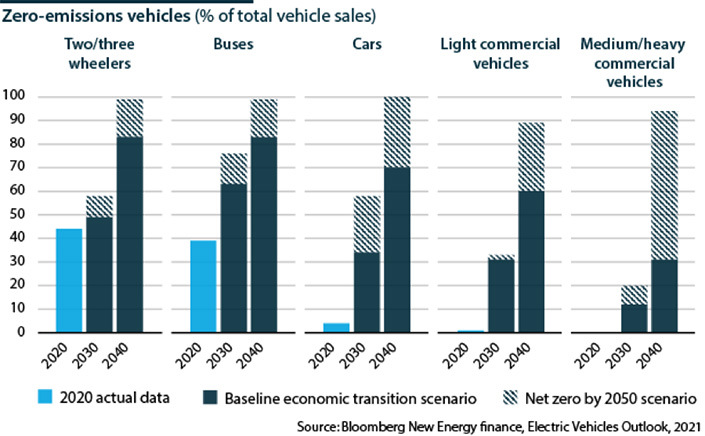

These projections are based on consumer trends but are also being driven by government policies that favor EVs over internal combustion engine (ICE) vehicles to reduce carbon dioxide emissions and limit the impacts of climate change.

EV production has been a priority for the Chinese government for more than ten years. More recently, the United Kingdom, the EU, the United States and Japan have announced significant incentives to accelerate investments throughout the EV value chain as an integral part of their strategies to achieve net-zero emissions by 2035.

Over the past decade, EV manufacturers led by Tesla, BYD and Nio have gained a significant share of the automotive market and now attract some of the highest valuations of any of the world’s carmakers.

Established companies are also committing to ramping up EV production to be ahead of government regulators and compete with new market entrants. Most incumbents are aiming to replace their ICE ranges completely with EVs by 2035. Automakers are already investing in new models and production systems to meet these long-range targets.

There are now around 330 pure EV and hybrid models in the global fleet, compared with 86 five years ago. Based on announcements by leading carmakers, analysts predict that there will be more than 500 models on the road by 2025.

|

EV challenges

The transformation of the global automotive industry to EV production is accelerating, but meeting the sales targets that automakers have set will be highly problematic. Four challenges stand in the way.

· Consumer acceptance

Auto producers will need to reduce the cost of EVs and extend their battery life and driving distance if they are to compete seriously with ICE vehicles without heavy government subsidies.

Investments will continue to target innovations in lightweight materials and the development of new, smaller and denser battery technologies that promise longer driving distances and greater energy efficiency. Batteries currently account for about 65% of the weight of standard EVs.

Market watchers believe that 2025 will be the inflection point when EV pricing, range and performance become competitive with ICE vehicles, spurring organic consumer demand. However, this assumes that:

· governments will continue to increase carbon taxes and maintain incentives for EV sales;

· manufacturers will keep increasing investments in new technologies; and

· consumers will change their purchasing habits once EVs become price-competitive.

All these assumptions remain far from certain.

· Infrastructure

Significant investments will be needed in electricity and manufacturing infrastructure to enable widespread, low-carbon EV transportation. A ubiquitous network of charging stations will be required to service a global fleet of EVs.

Moreover, because EV production creates about 60% more emissions than ICE vehicle manufacturing, low-carbon electricity for charging will be essential to guarantee that emissions show a net reduction over the lifetime of an EV.

Consequently, auto makers are investing heavily in advanced manufacturing and environmental technologies to reduce their overall carbon footprint. They are also localizing supply chains and delivery channels to lower the emissions involved in bringing in materials and parts, and sending out vehicles after assembly.

· Supply chain constraints

· Global battery production, and the mining and processing of minerals required to produce lithium-ion batteries, will have to accelerate rapidly to keep pace with EV sales targets. Lithium, graphite, manganese, cobalt and nickel are mined in some of the world’s poorest countries and then shipped to China for processing. Most of the world’s lithium battery production is also carried out in East Asia, mainly for the electronics industry. In Europe and North America, automotive batteries are in short supply.

China is the leading producer of automotive batteries thanks to a decade-long policy of subsidizing EV production, imposing sales quotas and requiring automakers to purchase Chinese-made batteries. It is home to 80% of the world’s refining capacity for the minerals used in battery production, 77% of battery manufacturing and 60% of battery component manufacturing. Where the United States has four large-scale battery manufacturing plants, China has close to 100.

New “gigafactories” — large plants making EV batteries from start to finish — are planned for China, the United States and Europe. However, mining, mineral processing and battery production are unlikely to expand rapidly enough to service the EV market if sales pick up as predicted beyond 2025.

· Geopolitical and economic risks

China’s predominance in battery production and the critical role that the automotive sector plays in all industrial economies guarantee that the EV market will be at the forefront of geopolitical and trade tensions as well as the scene of rivalry among auto manufacturers. Trade sanctions and export controls are already threatening the long-term supply of batteries, chips and the critical minerals used in battery and electronics production outside China.

The transition to EVs also threatens a large segment of global manufacturing. EVs require only about 15% of the number of components that go into an ICE vehicle. As the latter are phased out, demand for parts will drop sharply, affecting their manufacturers which today account for about two-thirds of the global automotive market.

Governments will face increasing pressure from business as well as labor groups to subsidize the components sector. They will need to balance this, at a time of increasing fiscal restraint, with their support for low-carbon mobility. EV production may become a polarizing political issue as jobs come under threat and factories close with the demise of ICE vehicle manufacturing.

This analysis was first published in the Oxford Analytica Daily Brief on Oct. 18, 2021. To learn more about the Daily Brief and Oxford Analytica, click here.

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.

You’ve accessed an article available only to subscribers

VIEW OPTIONS