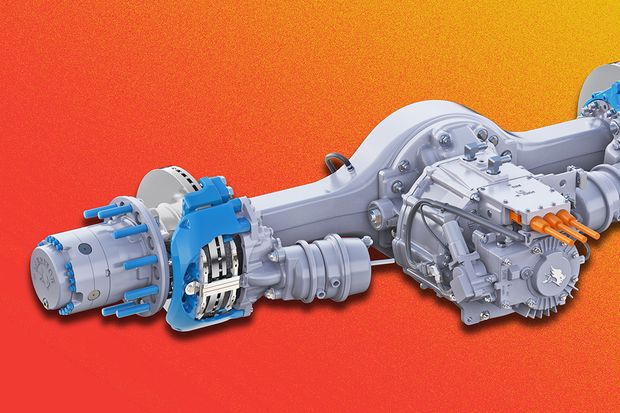

Meritor’s e-axles can be used on trucks that get electricity from fuel cells or batteries.

Courtest of Meritor

Text size

Even electric trucks need axles.

You wouldn’t know that by looking at

Meritor

stock (ticker: MTOR). Shares of the Troy, Mich.–based maker of heavy-duty truck parts have dropped more than 23%, to $21.31, this year, a sign that investors are fretting not only about issues like inflation and the business cycle but also about the company’s future in a world that’s increasingly going electric.

The latter point isn’t lost on Meritor. The company has been involved in vehicle electrification for more than a decade, launching its first hybrid drivetrain back in 2009. In 2017, the company started focusing on its electric axle platform, in which electric motors directly power an axle. More recently, Meritor has won business from

Hyliion Holdings

(HYLN) and

Hino Motors

(7205.Japan), while investing in SEA Electric in August.

If investors can get over some of their fears, the stock could soar.

Meritor began life as Timken Detroit Axle in 1909, which provided truck parts as the U.S. economy transitioned from horse-drawn wagons. After a series of mergers and spins, Meritor Automotive was created in 1997. The company sold its car business in 2011, focusing exclusively on commercial vehicles. These days, it makes truck axles, driveline parts, brakes, and suspensions, and has been moving into truck electrification. CEO Chris Villavarayan told Barron’s that Meritor’s customers have driven more than one million miles testing company products that enable electric trucks.

Today, Meritor is working with more than 30 truck makers on electrification.

| Key Data | |

|---|---|

| Headquarters: | Troy, MI |

| Recent Price: | $22.35 |

| YTD Change: | -20% |

| Market Value (bil): | $1.70 |

| 2022E Sales (bil): | $4.3 billion |

| 2022E Net Income (mil): | $265 million |

| 2022E EPS: | $3.93 |

| 2022E P/E: | 5.5 times |

| Dividend Yield: | None |

E=estimate. Note: fiscal year ends in Sept.

Source: FactSete

The company’s perceived obsolescence isn’t the only thing bugging investors, of course. As with all auto companies, rising costs are taking a toll. Steel prices, which have nearly quadrupled over the past year, have taken a bite out of profits. Steel should cease to be a problem in the near future, not because prices will go down, but because Meritor has contracts that will pass higher steel costs on to its customers.

Those contracts, though, are on a three- to six-month lag. That cost Meritor $30 million in steel and freight costs in its most recent quarter, a big headwind compared with $107 million in Ebitda—or earnings before interest, taxes, depreciation, and amortization—that the company reported in its most recent quarter. Meritor managed through it, generating a profit of 62 cents a share, beating forecasts of 50 cents.

Meritor hasn’t been rewarded for its solid financial performance, however. Its shares trade for just 5.4 times fiscal 2022 earnings estimates of $3.93 a share on sales of $4.3 billion. Fiscal year 2022 ends in September 2022. That’s a very low-valuation multiple, even for Meritor, whose shares have averaged a multiple of 11 times forward-year estimated earnings over the past five years. Competitors

Dana

(DAN) and

Oshkosh

(OSK) trade at 8.5 times and 13 times estimated earnings over the coming 12 months, respectively, while the

S&P 500

index trades at roughly 20 times.

With the company expected to earn $4.13 a share in calendar year 2022, returning to its previous multiple of 11 times earnings would mean the stock could trade as high as $45, more than double its current price. Even without a return to previous multiples, big gains are possible. RBC analyst Joe Spak, who sees the company earning $4.37 in calendar 2022, arrives at a $29 price target, implying a price/earnings ratio of less then seven times.

Spak’s estimate is higher than the Street’s. He sees earnings driven by strong demand for commercial vehicles into 2022. What’s more, Spak wrote recently that improving semiconductor supply should reduce production volatility. A global chip shortage has roiled the automotive industry, leading to low inventories, higher costs, and lost production. Though supply-chain stress is still a risk, says Villavarayan, the backlog of undelivered trucks is growing.

To really push the multiple higher, investors need some excitement—and Meritor might be able to deliver it. It is hosting an investor event on Dec. 7 and is expected to announce its latest multiyear plan, the so-called M2025.

The previous plan, which is almost complete, was all about financial execution and laying the groundwork to grow into vehicle electrification. Management wanted to generate $4 in per share earnings and 12.5% Ebitda margins by the end of this year—numbers they likely would have reached without Covid-19 and the supply-chain problems it introduced. The M2025 plan will focus on improving profit margins, too.

Investors should also expect the company to review its electric powertrain options, which can be used in battery or fuel-cell truck applications. “There will certainly be a lot more on electrification; there has to be,” says Villavarayan. He is focused on building Meritor’s electric business in not only big-rig Class 8 trucks, but in medium-duty trucks, too.

Convincing investors that Meritor can participate in the electric-vehicle future could give the stock the jolt it needs.

Write to Al Root at allen.root@dowjones.com