What happened

Many electric-vehicle (EV) stocks had a rough ride in March. Nearly all fell sharply in a broad sell-off early in the month, as concerns about rising interest rates in the United States led investors to reduce positions in higher-risk names.

While some, including category leader Tesla (NASDAQ:TSLA), were able to rally as March came to a close, other less-prominent names continued to lag into April.

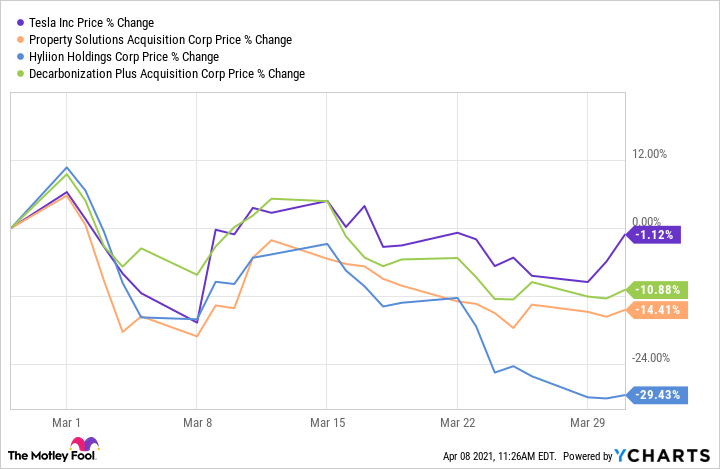

Here’s how these three companies’ stocks fared in March, according to data from S&P Global Market Intelligence.

- Decarbonization Plus Acquisition (NASDAQ:DCRB), a special-purpose acquisition company (SPAC) that is in the process of merging with electric-truck start-up Hyzon Motors, fell 10.9% in March.

- Hyliion Holdings (NYSE:HYLN), a maker of electric and hybrid powertrains for heavy trucks that went public via a SPAC deal in 2020, fell 29.4% in March.

- Property Solutions Acquisition (NASDAQ:PSAC), a SPAC that is in the process of merging with luxury EV start-up Faraday Future, fell 14.4% in March.

So what

Here’s a look at how all three stocks fared in March, with Tesla (in purple) added for reference.

TSLA data by YCharts.

Broadly speaking, EV stocks tend to follow Tesla’s ups and downs. But as you can see, Tesla’s big bounce at the end of March didn’t give these other stocks much of a lift. I think the explanation for that is pretty simple: While Tesla is a well-established business, these three companies have very little revenue. And while all have some promise, a closer look might help explain why EV investors remain wary.

- Hyzon Motors, based in Rochester, New York, is focused on medium- and heavy-duty vehicles (buses and trucks) fueled by hydrogen fuel cells. A spinoff of Singapore-based Horizon Fuel Cell Technologies, Hyzon expects to be able to deliver about 5,000 of its trucks and buses by the end of 2023. The transaction with Decarbonization Plus values Hyzon at $2.1 billion, and the combined company (which will retain the Hyzon name) will have about $576 million in cash, which it said is sufficient to fund its near-term business plan.

- Hyliion went public after completing a merger with a SPAC last year. The Texas company, led by Thomas Healy, an engineer trained at Carnegie Mellon University, designs hybrid and fully electric powertrains for heavy trucks that are then built and distributed by established truck-industry partners, including Tier 1 auto supplier Dana (NYSE:DAN). The company is currently shipping a hybrid system that can be retrofitted to existing diesel trucks. And it is working on its Hypertruck ERX, a complete electric powertrain compatible with Class 8 semis made by any of the six major heavy-truck manufacturers.

- While Faraday Future is still in start-up mode, the company has been around for several years. Originally hailed as a “Tesla killer” after a splashy presentation at the 2016 Consumer Electronics Show, it burned through $2 billion, lost its founder, and nearly went bust. A new CEO, ex-BMW executive Carsten Brietfeld, managed to steady the ship and set up the SPAC deal, which will give the combined company about $750 million in cash to proceed with its business plan.

Hyzon’s upcoming vehicles include an electric bus powered by hydrogen fuel cells. Image source: Hyzon Motors.

Now what

The next major events for Hyzon and Faraday will be the completion of their SPAC mergers. Both expect the deals to close by the end of June. Hyliion, which reported a narrower-than-expected loss for 2020 in February, will likely report its second-quarter results in early August.

This article represents the opinion of the writer, who may disagree with the “official” recommendation position of a Motley Fool premium advisory service. We’re motley! Questioning an investing thesis — even one of our own — helps us all think critically about investing and make decisions that help us become smarter, happier, and richer.