Dubbed the Rivian Adventure Network, it promises an ambitious, 600 super-charging stations offering 3,500 chargers by 2023 on routes across the United States and Canada. The chargers will be exclusive to Rivian owners, though a secondary, so-called Waypoint network of 10,000, 240-volt chargers will be open to the public at hotels and other businesses.

Electric Vehicles

Looking for a Chinese Electric Vehicle Stock? Just Ask Warren Buffett

Can you name the electric vehicle (EV) maker that was in the top 10 stocks by market value owned by Warren Buffett’s Berkshire Hathaway (NYSE:BRK.A) (NYSE:BRK.B) at the end of 2020? It might help to also know that the Berkshire investment has gone up 25 times in value as of Dec. 31, 2020, since the company initiated the investment in 2008.

It’s not Tesla (NASDAQ:TSLA), which Berkshire invested in early, but rather Chinese EV company BYD (OTC:BYDDY). And Berkshire owns more than 8% of the diversified EV and battery manufacturer. Investors may be surprised to know that even though NIO (NYSE:NIO) and others get more press, BYD has by far the most electric vehicle sales in China.

BYD Han luxury electric sedan. Image source: BYD.

A big lead

Since its founding in 1995, BYD has expanded globally. It has a much bigger business than just battery electric vehicles (BEVs), including batteries, electric commercial buses, trucks, and vans, as well as fossil-fuel-powered vehicles. But even restricting comparisons to BEVs, BYD is the largest Chinese manufacturer.

BYD sold 131,000 battery electric vehicles in 2020, and more than 460,000 total vehicles. By comparison, NIO sold 44,000 vehicles, 113% growth over 2019. NIO also announced a 352% increase in January 2021 deliveries compared to the prior-year period, but that still only totaled 7,225 electric cars.

Buffett’s interest

Berkshire purchased its stake in BYD through its MidAmerican Energy subsidiary in 2008, after Buffett’s partner Charlie Munger brought it to his attention. He was likely enticed by its broader scope in the electrification industry, beyond just electric cars. In a 2009 interview, Munger told Fortune that BYD founder Wang Chuanfu “is a combination of Thomas Edison and Jack Welch — something like Edison in solving technical problems, and something like Welch in getting done what he needs to do. I have never seen anything like it.”

That potential has been paying off recently around the world. BYD announced it received the largest all-electric bus order outside of China earlier this year. The order is for more than 1,000 municipal buses for the city of Bogota, Columbia.

BYD says its electrified public transportation solutions are currently running in over 300 cities in 50 countries around the world. Just this month, BYD said its new California-built 33-passenger K8M public transit bus set a new high-score record in the Federal Transit Administration (FTA) model bus testing program in Altoona, Pennsylvania. With high marks in structural durability, reliability, maintainability, and safety, the buses can now be purchased by U.S. transit authorities using FTA funding.

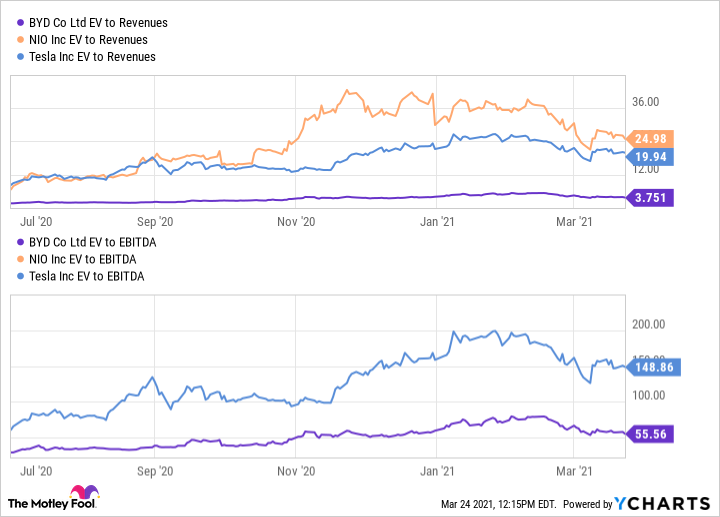

Even today, after the exponential rise in his investment, Buffett likely still must like the valuation compared to BYD’s peers. After the huge run in EV makers in 2020, none of them can be considered cheap by traditional measures. But BYD compares very favorably in enterprise value revenue or EBITDA, relative to both Tesla and NIO.

Note: NIO remains unprofitable and thus does not report EBITDA. Data by YCharts.

Leveraging expertise for future growth

The company is also leveraging its battery technology. As the largest global rechargeable battery maker, its products are used in consumer electronics, electric vehicles, and energy storage. BYD controls the full supply chain from mineral battery cells to completed battery packs. Its business model now includes a focus on renewable energy production, storage, and applications like solar power.

Some investors may not want to be overly aggressive with electric vehicle stocks after the sharp run many of the stocks had in 2020. But for those looking to be in the sector, BYD may be the Chinese EV maker you want to have a stake in. Investors are usually in good company with Buffett and Munger, and BYD shares have dipped almost 20% in 2021, making now a decent time to at least start a position.

This article represents the opinion of the writer, who may disagree with the “official” recommendation position of a Motley Fool premium advisory service. We’re motley! Questioning an investing thesis — even one of our own — helps us all think critically about investing and make decisions that help us become smarter, happier, and richer.

Electric vehicle incentives – federal

With interest and investment in electric vehicle (EV) technology increasing steadily, it is important for original equipment manufacturers, suppliers, dealers, and consumers to be aware of federal and state incentives available in the United States that may subsidize their particular EV decisions. These are some of the more important federal incentives to consider.

Qualified Plug-In Electric Vehicle (PEV) Tax Credit A tax credit is available for the purchase of new qualified PEVs that are propelled by a battery with at least four kilowatt-hours (kWh) of capacity, use an external source of energy to recharge the battery, have a gross vehicle weight rating at or below 14,000 pounds, and meet specified emission standards. The vehicles must be acquired for use or lease and not for resale and must be predominately used in the US. The minimum credit amount is $2,500 but may go up to $7,500, depending on battery capacity and other details. The credit phases out for the EVs of each particular manufacturer in the second quarter following their sale of 200,000 qualified PEVs in the United States. (References: IRS Plug-In Electric Drive Vehicle Credit (IRC 30D) website; IRS Form 8936 and Instructions for Form 8936; 26 U.S.C.A. § 30D.)

Qualified Electric Motorcycle Tax Credit A tax credit is available for the purchase of new qualified two-wheeled PEVs that are propelled by a battery with at least 2.5 kWh of capacity, use an external source of energy to recharge the battery, are manufactured primarily for use on public roadways, and can travel at least 45 miles per hour. The credit is the lesser of $2,500 or 10% of the cost of the vehicle. Qualifying two-wheeled vehicles must be purchased prior to January 1, 2022. (References: IRS Form 8936 and Instructions for Form 8936; 26 U.S.C.A. § 30D(g).)

Airport Zero-Emissions Vehicle (ZEV) and Infrastructure Pilot Program The FAA’s ZEV pilot program provides funding to eligible public-use airports to acquire ZEVs and to install or modify infrastructure required to support those vehicles. Qualifying vehicles are all-electric or hydrogen-powered, with those used for passenger and employee transport being the most commonly funded type. Relevant infrastructure includes refueling stations, rechargers, on-site fuel storage tanks, and other equipment needed for station operation. Priority is given to applications that will achieve the greatest air quality benefits measured by cost per ton of emissions reduced. In addition to standard grant assurances and Buy American requirements, ZEV-funded equipment must remain at the airport, the airport sponsor must track and maintain records of ZEV-funded equipment use, and ZEV equipment must remain in use during the equipment’s useful life. (References: Airport ZEV and Infrastructure Pilot Program website; program brochure; 49 U.S.C.A. § 47136.)

Alternative Fuel Infrastructure Tax Credit Qualified refueling equipment for EVs and other alternative fuel vehicles installed before the end of 2021 is eligible for a federal tax credit. For business/investment refueling equipment subject to an allowance for depreciation, the credit for all property placed in service at each location is generally the smaller of 30% of the property’s cost or $30,000. For personal use refueling equipment not subject to a depreciation allowance and placed in service at the taxpayer’s main home, the credit is generally the smaller of 30% of the property’s cost or $1,000. Permitting and inspection fees are not included in covered expenses. Unused business tax credits may be carried backward one year and carried forward 20 years. (References: IRS Form 8911 and Instructions for Form 8911; 26 U.S.C.A. § 30C.)

Advanced Technology Vehicles (ATV) Manufacturing Loan Program Manufacturers of eligible ATVs and related components and infrastructure may be eligible for direct loans at US Treasury rates for up to 30% of the cost of reequipping, expanding, or establishing manufacturing facilities, including associated hardware and software, used to produce such products. Qualified ATVs are light-duty or ultra-efficient vehicles that meet specified federal emission standards and fuel economy requirements, generally a 25% improvement in fuel efficiency compared with 2005 baselines or a 75-miles-per-gallon equivalent using alternative fuels (including electricity). The project must be located in the US, with foreign ownership or sponsorship permissible, and must provide for a reasonable prospect of repayment. Other conditions apply, including Department of Energy (DOE) Loan Programs Office (LPO) review and approval of any application. (References: ATV Manufacturing Loan Program website; ATV Loan Program Fact Sheet; 42 U.S.C.A. § 17013.)1

Improved Energy Technology Loans The DOE also provides Title XVII loan guarantees to eligible innovative energy projects that avoid, reduce, or sequester air pollutants and greenhouse gases by using advanced technologies not yet widely deployed in the US. The DOE may issue loan guarantees for up to 100% of the amount of the loan for an eligible project. Deployment of EV-related infrastructure, including associated hardware and software, may be eligible. The project must be located in the US, with foreign ownership or sponsorship permissible, and must provide for a reasonable prospect of repayment. Other conditions apply. (References: LPO website; LPO Eligibility Fact Sheet; 42 U.S.C.A. § 16513.)

Advanced Energy Research Project Grants The Advanced Research Projects Agency-Energy (ARPA-E) was established within the DOE to advance high-potential, high-impact energy technologies that are too early for private-sector investment but have the potential to radically improve US economic prosperity, national security, and environmental well-being. The ARPA-E focuses on various concepts in multiple program areas, including but not limited to vehicle technologies, biomass energy, and energy storage, and it looks for projects that can be meaningfully advanced with a small amount of funding over a defined period of time. (References: ARPA-E website; ARPA-E FAQs.)

Low- and Zero-Emission Public Transportation Funding Financial assistance is available to government entities, public transportation providers, private and nonprofit organizations, and higher education institutions for research, demonstration, and deployment projects involving low- or zero-emission public transportation vehicles. Vehicles must be designated for public transportation and significantly reduce energy consumption or harmful emissions compared with a comparable standard vehicle. Funding was available through fiscal year 2020 but is subject to Congressional appropriations thereafter. (References: Public Transportation Innovation Program website; Low or No Emission Vehicle Program website; 49 U.S.C.A. § 5312; 49 U.S.C.A. § 5339(c).)

PEV Weight Exemption PEVs and natural gas vehicles may exceed the federal interstate maximum gross vehicle weight limit for comparable conventional-fuel vehicles by up to 2,000 pounds (lbs.). The PEV must not exceed a maximum gross vehicle weight of 82,000 lbs. (Reference: 23 U.S.C.A. § 127(s).)

Biden Executive Order to Convert Federal Fleet Although not formally an incentive, the recent Biden executive order directing, among other things, the conversion of the entire federal vehicle fleet to EVs will influence the market and pricing for EVs. To the extent there are roughly 645,000 vehicles in the federal fleet, including passenger vehicles, heavy trucks, vans, and others, and only about 4,500 of those are presently EVs, according to the General Services Administration, this directive alone could increase the total number of EVs on US roads by more than 50%, depending on when and how it is finally implemented. Having such a large guaranteed public buyer enter the market is a significant de facto incentive for EV makers and suppliers. (Reference: Executive Order on Tackling the Climate Crisis at Home and Abroad § 205(b)(ii).)2

Xiaomi Said to Plan Electric Vehicle Production Using Great Wall Motors’ Factory

China’s Xiaomi Corp plans to make electric vehicles (EVs) using Great Wall Motor’s factory, said three people with direct knowledge of the matter, making it the latest tech firm to join the smart mobility race.

The tech firm’s stock price jumped as much as 6.71 percent in early Friday trade after Reuters reported the plan. Great Wall’s Hong Kong stock rose more than 8 percent and its Shanghai shares gained than more than 7 percent.

Xiaomi, one of the world’s biggest smartphone makers, is in talks to use one of Great Wall’s plants in China to make EVs under its own brand, said two of the people, who declined to be identified as the information is not public.

Xiaomi will aim its EVs at the mass market, in line with the broader positioning of its electronics products, the two people said.

Great Wall, which has not before offered manufacturing services to other companies, will provide engineering consultancy to speed up the project, said one of the people.

Both companies plan to announce the partnership as soon as early next week, said one of the people.

Xiaomi and Great Wall declined to comment.

The plan comes as eight-year-old Xiaomi seeks to diversify its revenue streams from the smartphone business which accounts for the bulk of its income but carries razor-thin profit margins. It flagged on Wednesday rising costs from a global chip shortage and reported quarterly revenue below market estimates.

The move also comes against the backdrop of automakers and tech firms working closer together to develop smarter vehicles with technology such as smart cabins and autonomous driving.

Chinese search engine provider Baidu said in January it plans to make EVs using an auto plant owned by Geely – an automaker with aspirations to offer engineering consultancy and contract manufacturing.

Reuters has also reported Apple and Huawei’s respective auto ambitions.

Xiaomi’s founder and chief executive, Lei Jun, believes the firm’s expertise in hardware manufacturing will help accelerate the design and production of its EVs, one of the people said.

Alongside smartphones, Xiaomi makes dozens of Internet-connected devices including scooters, air purifiers, and rice cookers.

The firm plans to launch its first EV around 2023, one of the people said. It will enable its cars to connect with other devices in its product eco-system, the people said.

Baoding-based Great Wall, China’s biggest pickup truck maker, this year launched a standalone brand for electric and smart vehicles. It is also building an EV factory in China with Germany’s BMW.

The automaker sold 1.11 million vehicles last year helped by the popularity of models such as the P-series pickup truck and Ora EVs. It is currently building its first factory in Thailand.

© Thomson Reuters 2021

Some important changes are taking place with Orbital podcast. We discussed this on Orbital, our weekly technology podcast, which you can subscribe to via Apple Podcasts, Google Podcasts, or RSS, download the episode, or just hit the play button below.

CORRECTING and REPLACING HomeServe and CenterPoint Energy Launch New Coverage for Electric Vehicle Home Charging Protection Plan

NORWALK, Conn.–(BUSINESS WIRE)–Please replace the release dated March 24, 2021 with the following corrected version due to multiple revisions.

The updated release reads:

HOMESERVE AND CENTERPOINT ENERGY LAUNCH NEW COVERAGE FOR ELECTRIC VEHICLE HOME CHARGING PROTECTION PLAN

HomeServe and CenterPoint Energy are working together to launch an industry first product now available to CenterPoint’s Texas customers. Building on current repair service plan from HomeServe that covers problems with CenterPoint customers’ interior electric wiring, the new offering will allow residential customers with Electric Vehicles (EV) to add enhancement coverage for their home EV charging systems.

Starting at just $8.99 per month, the new no-deductible coverage will provide up to $500 in reimbursement for a Level 2 home EV charger that stops working due to normal wear and tear. The additional EV charger coverage is on top of the core Interior Electric plan elements, which includes up to $2,500 of annual coverage for repair or replacement of the high voltage wiring including switches, outlets and disconnect boxes that are damaged due to normal wear and tear.

“Americans are increasingly buying Electric Vehicles with the market expected to grow by over 20% each year between 2019 and 2030*. As more and more Americans bring these cars home, they are also faced with the challenge of ensuring their cars can easily be charged while parked in their driveways and garages,” said Tom Rusin, Global CEO of HomeServe Membership. “HomeServe is excited to be among the first to offer this new coverage that gives peace of mind to EV owners, ensuring quick repair or replacement of their home charging station if it breaks down.”

A HomeServe 2020 Electric Vehicle Charger Study found that 75% of EV owners use a Level 2 charger for charging at home and that almost three-quarters of prospective EV buyers (74%) are worried that their charger could break or malfunction. The survey also found that almost one-third of EV owners (29%) expect their utility to help with their home charging needs, and an almost unanimous number of respondents (97%) who use a Level 2 charger at home said they would be interested in an offer from their electric utility that included EV charger installation.

“Electric Vehicle Market by Vehicle (Passenger Cars & Commercial Vehicles), Vehicle Class (Mid-priced & Luxury), Propulsion (BEV, PHEV & FCEV), EV Sales (OEMs/Models) Charging Station (Normal & Super) & Region – Global Forecast to 2030“, Electric Vehicle Market, June 2019

About HomeServe

HomeServe USA Corp. (HomeServe) is a leading provider of home repair solutions serving more than 4.5 million customers across the US and Canada under the HomeServe, Home Emergency Insurance Solutions, Service Line Warranties of America (SLWA), Service Line Warranties of Canada (SLWC) names, and through locally branded HVAC companies located in major metro areas. Since 2003, HomeServe has been protecting homeowners against the expense and inconvenience of water, sewer, electrical, HVAC and other home repair emergencies by providing affordable repair coverage, installations and quality local service.

As an A+ rated Better Business Bureau Accredited Business, HomeServe is dedicated to being a customer-focused company supplying best-in-class repair plans and other services to consumers directly and through over 1,000 leading municipal and utility partners.

HomeServe has teamed up with executive producer, host, and best-selling author Mike Rowe, best known as the creator and host of the hit TV series Dirty Jobs, to work together to provide homeowners expert advice on maintaining, enhancing and protecting their homes. For more information about HomeServe, a Great Place To Work certified winner and recipient of thirty 2020 Stevie Awards for Sales & Customer Service, or to learn more about HomeServe’s affordable repair plans, please go to www.homeserve.com. Connect with HomeServe on Facebook and Twitter @HomeServeUSA. For news and information follow on Twitter @HomeServeUSNews.

Electric vehicle rebate bill passes NY Senate

Posted:

Updated:

An electric car stand at a loading station of a car dealer in Bad Homburg, Germany, Thursday, Sept. 3, 2020. (AP Photo/Michael Probst)

ALBANY, N.Y. (NEWS10) – A bill that would increase the rebates available to municipalities electrifying their vehicle fleets has passed through the New York State Senate. The bill will double the minimum rebate for municipalities purchasing electric vehicles, increasing it from $750 to $1,500. The maximum rebate available will also increase by $2,500 to $7,500.

Senator Michelle Hinchey, who sponsored the bill, said: “Creating larger municipal rebates is an important step that will help propel us toward a more stable climate, cleaner air, and a much-needed transition to pollution-free vehicles.”

“Electric vehicles provide a unique opportunity for New York to significantly reduce our greenhouse gas emissions and protect the health of our communities and our planet.

New York already leads the nation in our commitment to fighting climate change, and this legislation is the latest example of our efforts to create logical and affordable solutions at the local level.

Every municipality that wants to green its fleets should have the opportunity to do so, but with limited revenue, these upfront investments are difficult to undertake. Creating larger municipal rebates is an important step that will help propel us toward a more stable climate, cleaner air, and a much-needed transition to pollution-free vehicles.”

Senator Michelle Hinchey

Advocates for the bill argue that, along with helping municipalities electrify their fleets, it will help areas that are currently ineligible for federal tax incentives related to purchasing zero-emission or hybrid vehicles.

Senators introduce bipartisan bill to expand electric vehicle charging tax credit | TheHill – The Hill

Labour outlines plan for ‘electric vehicle revolution’

The Labour Party has put forward a plan to accelerate electric vehicle (EV) uptake across the UK, including providing interest-free government loans for buyers.

Shadow business secretary Ed Miliband has outlined three ways that a Labour government would usher in an “electric vehicle revolution”.

First, the ex-Labour leader promised to provide interest-free loans to help working-class and middle-class households afford EVs and called for the UK government to introduce these loans within two years.

Second, Miliband said Labour would invest in three more electric vehicle battery gigafactories for the UK by 2025.

Finally, he committed to accelerating the roll-out of electric chargers, especially in the north of England, where chargers are currently sparse.

He said: “To back the car industry and create jobs, Labour would bring forward ambitious proposals to spark an electric vehicle revolution in every part of the country.

“By extending the option to buy an electric car to those on lower incomes and accelerating the roll-out of charging points in regions that have been left out, we would ensure that everyone could benefit.”

Labour’s proposals act as an implicit rebuke to the green efforts of the current Conservative government.

The government’s radical move to ban sales of all new ICE cars by 2030, although superficially attractive, has been criticised across the car industry for being ill-thought out and potentially damaging.

Similarly, while prime minister Boris Johnson has championed the funding of other initiatives such as a £20 million competition to increase EV innovation, announced earlier this month, the reality is that much of these funds have already been allocated and are recycled from Theresa May’s previous government.

Industry figures have been raising questions about the cost of EVs for some time, a problem that looks set to worsen as the government this week downsized its plug-in car grant, which helps make EVs more affordable, from £3000 to £2500.

The current lack of a gigafactory in the UK is also a problem. Last year, then Jaguar Land Rover CEO Ralf Speth said: “If batteries go out of the UK, then automotive production will go out of the UK.”

Labour’s proposals have been warmly received, particularly its call to build more gigafactories. SMMT boss Mike Hawes said: “We have a strong and world-renowned automotive industry. It’s not the biggest, but it’s synonymous with quality, premium and high engineering excellence.

“We need to transfer that into electrification, and to ensure that we maintain the scale that we have, we do need gigafactories. Any mechanism that helps create the conditions for investment, helps attract the investment into the UK, we would support. Because we know that at the moment we are short of battery manufacturing and we need it to comply with future trade deals. We need it to be able to sustain the industry.”

READ MORE

Government cuts electric car grant from £3000 to £2500

Which electric cars no longer qualify for a grant in the UK?

The road to 2030: how the UK must prepare for an EV revolution

LG Chem’s Win In $1 Billion Electric Vehicle Trade Secret Dispute Upheld By International Trade Commission – Intellectual Property

United States:

LG Chem’s Win In $1 Billion Electric Vehicle Trade Secret Dispute Upheld By International Trade Commission

To print this article, all you need is to be registered or login on Mondaq.com.

Global competition in high-tech industries is as intense as

ever, and U.S. administrative agencies continue to find themselves

at the center of global disputes between foreign companies seeking

to vindicate trade secret and intellectual property rights. That

outlook was confirmed this month in a highly-anticipated ruling by

the International Trade Commission (“ITC”) in a trade

secret dispute between two South Korean manufacturers of electric

vehicle batteries.

On February 10, 2021, the ITC issued its final determination (Inv. No. 337-TA-1159)

affirming an administrative law judge’s (“ALJ”)

initial determination that the South Korean company SK Innovation

had violated Section 337 of the Tariff Act of 1930 by

misappropriating trade secret information regarding electric

vehicle batteries from LG Chem, Ltd., also from South Korea. The

ALJ had entered a default judgment against SK Innovation on

February 14, 2020, finding that SK Innovation had spoliated

evidence by destroying documents relevant to the case. As a remedy,

the ITC barred the imports of SK Innovation’s lithium-ion

battery products for 10 years. However, the ITC made a number of

important exceptions in light of public interest considerations.

First, the ITC permitted SK Innovation to continue importing

components for domestic production of lithium-ion battery products

for Ford Motor Co.’s electric F-150 production for four years

and for Volkswagen of America’s MEB line for the North America

Region for two years, in order to permit the auto-makers to

transition to new domestic suppliers. Second, the ITC permitted SK

Innovation to import articles for repair and replacement of

electric vehicle batteries for Kia vehicles equipped with SK

Innovation batteries that were sold to American customers before

February 10, 2021. The Biden Administration has 60 days to review

the ITC’s order.

The ITC’s investigation was initiated in June 2019 based on

a complaint filed by LG Chem, Ltd. and LG Chem Michigan, Inc.

against SK Innovation with the ITC and the District of Delaware,

alleging that SK Innovation had violated the Defend Trade Secrets

Act and the Delaware Uniform Trade Secrets Act by misappropriated

its electric vehicle battery trade secret information. LG Chem

alleged that SK Innovation had systematically stolen the

information by poaching former LG employees, including scientists,

engineers, and business individuals, and improperly obtained trade

secret information from the employees. LG Chem alleged that the

misappropriation had cost them over $1 billion in revenue.

This case highlights the relationship of ever-expanding

globalization with U.S. trade secret law, especially in high-tech

industries such as electric vehicles. The case has established U.S.

administrative agencies as a potential forum for foreign companies

doing business with U.S. companies to litigate trade secret and

intellectual property disputes. It is foreseeable that other

foreign companies competing in the U.S. may use similar avenues for

litigating trade secret disputes in future cases.

The content of this article is intended to provide a general

guide to the subject matter. Specialist advice should be sought

about your specific circumstances.

POPULAR ARTICLES ON: Intellectual Property from United States

‘Still far too low’: Australia’s electric vehicle industry says fourfold imports jump not enough | Electric, hybrid and low-emission cars

Australia has recorded the largest bump ever in electric vehicle imports over the first two months of the year but industry figures say the result is still not good enough.

Import figures released by the Australian Bureau of Statistics (ABS) on Wednesday show the dollar value of electric vehicle (EV) imports has grown $104m to $125m in the first two months of 2021, representing an increase of 485% on figures recorded at the same time last year.

Hybrid-vehicle sales were up $95m to $190m, growing 101%.

The ABS says this represents a four-fold increase on electric vehicle imports into Australia, “the highest month on record for electric vehicle imports”.

“These increases align with media reports of a shift in demand for electric vehicles in early 2021 as a greater range is made available in Australia,” the release said.

These numbers were bundled into a $705m growth in overall vehicle sales, seeing the total value of the industry climb 24% to $3.72bn.

Vehicle import numbers are typically weak in January and February, but the growth in figures is in keeping with an economy rebounding from the worst effects of the pandemic.

While the EV results have been welcomed as a signal of growing demand and a recovering economy, the growth was achieved off a very low base.

Behyad Jafari, chair of the Electric Vehicles Council said 558 electric cars had sold in the first two months of 2021, including plug-in hybrid electric vehicles, but not counting cars sold by Tesla as the company does not publicly release its numbers.

Last year just 272 EVs sold in the same period.

“There are not enough zeros on the ABS numbers,” Jafari said. “It’s great that the numbers have gone up but it’s still low. If we were a comparable nation to other developed countries around the world, we’d be talking about 10,000 to 20,000 cars sold in the first two months of this year.”

Jafari said the lack of federal government policy and initiatives, like that from the Victorian state government to “tax” EV owners and require them to keep a paper logbook of their vehicle use, will only dampen demand in the sector.

This is in stark contrast to the policies being proposed elsewhere, including a plan by UK Labour’s shadow business secretary, Ed Milliband, to rapidly drive up electric vehicle sales with no-interest loans.

“It’s pretty clear that in a massively lagging nation the number has gone up relatively but still far too low overall,” Jafarai said.

“What we’ve seen is government going in the wrong direction by introducing a very harmful and premature new tax in Victoria. The most meaningful action in this area has been a detrimental move.”

“We don’t need to guess why when car companies have told us very clearly it’s not that the consumers don’t want to buy them, it’s because we can’t bring them in. Other countries have policies, and you don’t.”