GM Is Betting Big On Electric Vehicles Yahoo Finance

Electric Vehicles

GM Is Betting Big On Electric Vehicles

Weeks after General Motors pledged to work for an all-electric future, the highest-selling U.S. automaker announced this week a partnership with MIT spinoff SolidEnergy Systems to speed up the commercialization of lithium metal batteries that could dramatically cut electric vehicle (EV) costs and boost range. GM Ventures was an early investor in lithium metal battery innovator SolidEnergy Systems in 2015 when GM and SES began a close working relationship.

Now GM and SES plan to build a manufacturing prototyping line in Woburn, Massachusetts, for a high-capacity, pre-production battery by 2023. GM’s lithium metal battery with a protected anode will feature a combination of affordability, high performance, and energy density, the carmaker said.

“Affordability and range are two major barriers to mass EV adoption,” General Motors President Mark Reuss said.

“With this next-generation Ultium chemistry, we believe we’re on the cusp of a once-in-a-generation improvement in energy density and cost. There’s even more room to improve in both categories, and we intend to innovate faster than any other company in this space,” Reuss added.

GM committed in January to eliminate all tailpipe emissions from new light-duty vehicles by 2035 as part of a wider strategy to become a carbon-neutral business by 2040.

The automaker had already stated in November 2020 its ambition to lead in the EV race with higher investments and 30 new global EV launches by 2025. Back then, GM said that its Ultium battery packs are projected to cost 60 percent less than today’s packs with twice the energy density. GM’s Ultrium-based EVs, when produced, will be capable of driving ranges up to 450 miles on a full charge, the carmaker said.

Related: How Middle East Producers Are Pricing Their Oil

Range and battery cost improvements, not only from GM but also from other players in the increasingly crowded EV market, are set to lower EV prices and boost their performance—the two key hurdles to attracting even more consumers.

Battery costs have fallen by 87 percent since 2010, but additional cost declines will be necessary so that EV prices could erase the current price advantage of conventional cars.

Further cost reductions in battery pack prices could allow EVs to compete with ICE cars when battery pack prices drop to $100 per kilowatt-hour in 2023, BNEF’s 2020 Battery Price Survey showed in December.

Average battery prices below $100/kWh are widely considered the tipping point for mass EV adoption.

According to recent research from Cairn Energy Research Advisors, cited by CNBC, Tesla leads the EV race in battery cost reductions and will continue to do so this decade, but GM—thanks to its all-electric commitment—will narrow the gap and close in on Tesla’s battery costs by the end of this decade.

Cairn Energy Research Advisors has estimated that Tesla currently pays an average of $142/kWh for battery cells, compared to GM’s $169/kWh and an industry average of $186/kWh.

Tesla’s battery packs cost on average $187/kWh versus GM’s packs cost at $207/kWh and the auto industry’s average of $246/kWh for battery packs, Cairn ERA said.

“GM is fully committed and is taking this complete integrative approach which is going to allow it to be very close to Tesla, although the scale still isn’t in the same ballpark as what Tesla is planning,” Sam Jaffe, managing director of Cairn ERA, said in the report, as carried by CNBC.

Tesla is the EV maker to beat in the increasingly heated race for zero-emission transportation. The growing EV market with legacy automakers from GM to Volkswagen—and even start-ups—could prove the catalyst the entire EV industry needs to win over consumers with higher vehicle ranges and lower car prices.

By Tsvetana Paraskova for Oilprice.com

More Top Reads From Oilprice.com:

Electric vehicle start-up Canoo’s new pickup and camper

Canoo is an electric automaker start-up with a reputation for producing cars with a unique aesthetic. It certainly lived up to that reputation with the unveiling of its new electric pickup truck on Thursday.

The new pickup, which will begin preorders in the second quarter of 2021 before hitting the market in 2023, features a flat front with an almost bubble-like windshield.

Canoo said in a statement that the company designed the vehicle “to be the most cab-forward and space efficient on the market, with massive cargo capacity on the smallest footprint possible.”

EV start-up Canoo unveiled its electric pickup on March 11, 2021.

Canoo

EV start-up Canoo unveiled its electric pickup on March 11, 2021.

Canoo

The flat front design, which is similar to a van, basically puts the driver almost on top of the truck’s front wheels, allowing for more storage space in the cab and the rear cargo bed. The electric pickup also features a front cargo storage area that, Canoo says, “can hold tools or gear, also includes a fold down worktable with electrical outlets.”

A fold-out worktable in the front of Canoo’s electric truck.

Source: Canoo

And the 6-foot-long rear cargo bed has an overall payload capacity of 1,800 pounds, while also featuring a pull-out extension that reaches 8 feet in overall length.

Canoo’s new electric pickup features an extendable rear cargo bed.

Source: Canoo

The pickup is also designed to fit “a vareity of camper shells,” the company said, which would allow drivers to convert the electric truck into a mobile camper with additional storage and space for sleeping. (Canoo has not yet announced a base price for the electric pickup, or what additional costs it might charge for add-ons, like a camper or roof racks.)

Canoo’s new electric pickup can convert into a camper.

Source: Canoo

Canoo says the electric pickup will feature up to 600 horsepower and a battery range of more than 200 miles. That range falls short of some other electric pickups likely to hit the market in the next year or two, including Tesla’s Cybertruck (with a range of 250 miles to more than 500 miles, depending on the version) in 2022.

The pickup reveal stirred up some excitement around Canoo’s stock, causing shares of the company to surge more than 20% from Thursday into Friday. Founded in 2017, the company went public in December, following a merger with a special purpose acquisition company, or SPAC. That same month, Canoo unveiled a futuristic, boxy electric van for commercial customers called a multipurpose delivery vehicle, or MPDV.

Canoo’s van – known as a multipurpose delivery vehicle, or MPDV, because of the ways it can be upfitted – is designed for commercial customers.

Canoo

CT looks to revive struggling electric vehicle subsidies program

Connecticut is trying to put tens of thousands more electric vehicles on the road in the coming years to help tackle climate change and build a green economy.

But its Connecticut Hydrogen and Electric Automobile Purchase Rebate (CHEAPR) program last year allotted only a few hundred rebates, with its output dropping precipitously from 2019. State officials are hoping, however, that this year marks the start of a comeback, with a number of changes aimed at expanding the program’s reach.

“It might sound strange to say that the program is both underspent and underfunded, but if it were more aggressively positioned then the funds would be utilized,” Barry Kresch, who serves as the president of the EV Club of Connecticut and bought a Chevy Volt with a CHEAPR rebate, said during testimony March 3 to the state legislature’s Transportation Committee.

More Information

The Connecticut Hydrogen and Electric Automobile Purchase Rebate (CHEAPR) program provides subsidies for the purchase and lease of electric vehicles. While the program grew in its first few years, it experienced a major downturn in 2020.

Total rebate dollars distributed

2015: $909,750

2016: $1,595,250

2017: $2,502,000

2018: $3,414,000

2019: $2,531,000

2020: $723,500

Total number of rebates awarded

2015: 379

2016: 704

2017: 1,288

2018: 1,808

2019: 1,605

2020: 675

Source: Connecticut Department of Energy and Environmental Protection

Recent struggles

Launched in 2015, CHEAPR provides incentives for Connecticut residents who purchase or lease new battery-electric, plug-in hybrid electric or fuel-cell electric vehicles.

More than 30 vehicles qualify for rebates, although eligible cars’ manufacturer-suggested retail prices cannot exceed $42,000 for battery-electric and plug-in hybrid models or $60,000 for fuel-cell cars. Rebates are limited to one person or two per organization.

The state Department of Energy and Environmental Protection manages CHEAPR. The program receives $3 million in annual funding, which comes from fees for new vehicle registrations and vehicle registration renewals.

After expanding its reach in its first few years, CHEAPR struggled in 2020. Rebate dollars distributed through the program dropped more than 70 percent from 2019 to about $723,500, while the number of rebates plunged nearly 60 percent to 675.

“The pandemic is probably the biggest impact because that drove down light-duty vehicle sales, and you see EV sales drop — but not as much,” Paul Farrell, DEEP’s director of air planning, said in an interview. “COVID also led to some of the manufacturers looking at their production levels and model availability. You had some models going out that just weren’t available anymore that were fairly popular, like the Chevy Volt.”

Reflecting the dwindling demand, CHEAPR expended last year only about 30 percent of its $3 million allotment. The unspent $2.1 million has been rolled over into the program’s 2021 budget.

CHEAPR’s travails reflects the difficulty Connecticut faces in reaching its electric-vehicle goals, as it tries to reduce automobile emissions. Connecticut suffered from “some of the worst air quality in the country,” and the transportation sector accounted for 38 percent of its greenhouse-gas emissions, according to the “Electric Vehicle Roadmap” published last year by DEEP.

State officials are aiming to help put 125,000 to 150,000 electric vehicles on the road in Connecticut by 2025. But as of Jan. 1, there were only 13,800 EVs registered in the state, according to the state Department of Motor Vehicles.

“We’ve made some good progress with the CHEAPR program, but it’s simply insufficient and consistently underfunded,” state Rep. Jonathan Steinberg, D-Westport, a Transportation Committee member, said last month. “If we’re really going to move the needle, we need to enable working-class people to get EVs, probably previously owned and certainly subsidized.”

In another effort to spur greater use of electric vehicles, Steinberg and state Sen. Will Haskell, D-Westport, have introduced a bill that would allow EV manufacturers such as Tesla to directly sell their automobiles to Connecticut customers without operating franchised dealerships.

Ideas for improvement

Responding to the criticism, DEEP is planning to institute this year several changes to make CHEAPR’s subsidies more accessible.

The CHEAPR board approved last month a revised group of incentives, which include — for the first time — rebates for used electric vehicles.

Under the new parameters, base incentives for new and used electric vehicles will range from $500 to $5,000. In addition, there will be supplemental new-vehicle incentives, ranging from $1,500 to $2,000, for low-to moderate income applicants. DEEP also expects to offer an additional “economic stimulus incentive” that will be available from the launch of the new stage of the program in April through December.

“We’re incredibly excited about this new opportunity to increase and broaden the program to the low-to-moderate-income community and make the program more equitable,” Farrell said. “We’re hopeful that in conjunction with the COVID vaccines and the economic recovery… instead of having limited vehicle availability and limited sales, we’ll see increases across the board.”

Car dealers are also committed to the program. Connecticut Automotive Retailers Association officials said that they assisted DEEP in creating CHEAPR and work with the department on providing updates to dealerships and facilitating CHEAPR-related training.

“CARA supports expanding the program to include rebates for used electric vehicles and to provide enhanced rebates that will open the market to a broader range of buyers,” said CARA President Sarah Fryxell. “The amount of EVs sold in Connecticut continues to grow, which is a testament to the commitment of locally owned dealerships’ to meeting the needs of our customers and to Connecticut’s clean air efforts. We look forward to an improved CHEAPR program.”

The EV Club of Connecticut’s Kresch said he supports those new “equity provisions,” but that he still wants to restore former rebate and price parameters. Among changes implemented in October 2019, the price limit for battery-electric and plug-in hybrid electric vehicles was lowered from $50,000 to $42,000. DEEP officials said those changes responded to a program spending rate that would have exceeded available funding at that time.

CHEAPR’s board voted last month to maintain the $42,000 price cap.

“My larger concern about CHEAPR is that it has been underperforming for the past year and a half,” Kresch told the Transportation Committee. “While there has been a pandemic and recession, the main reason [for last year’s decline in rebates] was the changes in the program parameters dating to October 2019.”

Among other efforts to improve CHEAPR, the Transportation Committee approved this week a bill that directs CHEAPR’s board to launch a study to “ensure the equitable distribution” of grants. The study results would be due to the committee by Feb. 1, 2022.

DEEP officials said that they would have preferred to submit in January 2023 a summary of the CHEAPR incentives, a timeframe that they said would allow them to assess the impact of the new components.

“We just don’t think you need a study at this point,” Farrell said. “Let’s unleash this program, let’s see what happens. Let’s get some data, and let’s see how we’re doing.”

Amid the push for more electric cars, Kresch and other constituents have suggested adding other types of subsidies.

In the March 3 hearing, Kate Rozen called for the launch of a pilot program that would offer incentives for e-bikes and e-mopeds, focusing on low-to-middle-income households. In 2019, Rozen purchased an electric cargo bike to commute from Woodbridge to New Haven.

“I don’t believe we can achieve those [CHEAPR] goals by excluding the electric bicycle,” Rozen said. “The cost to leave out a whole mode of electric transportation is way too high for city residents suffering from pollution of our car-centric world. The electric bicycle should be held up as commensurate to the electric vehicle in our climate and health toolkit, particularly because of its lower cost of entry.”

pschott@stamfordadvocate.com; twitter: @paulschott

Tesla seems ready for India. Is India ready for Tesla? – Fortune

Driving EV during Malaysia road trip could trigger range anxiety; users call for more infrastructure

SINGAPORE: Mr Koh Jie Meng has driven from Singapore to different parts of Malaysia more than 20 times in his electric Hyundai Kona SUV since he bought the car in 2019.

He described the journeys as “smooth and seamless” now, but he acknowledged that this was not always the case during his first few attempts at driving from his home near Yishun to Kuala Lumpur for business meetings.

“At the start, I had some anxiety because I started driving too fast on the highways. I learnt that you have to watch your speed, travel only at 100 to 110kmh so I can get there easily,” said Mr Koh.

He is now more seasoned but he did learn some lessons the hard way.

He figured out that speeding would deplete the car’s battery life sooner and would leave him scrambling to find an electric charging point along the journey.

He also shared that putting the air conditioner at full blast while being stuck in traffic congestion at the Causeway would also drain the battery fast.

Mr Koh outlined that the most important factor in completing the journey safely was planning.

“You need to know your car’s battery range. For my Kona, it is a long-range electric car so I can do a single charge run. This means I can drive straight from Singapore to Kuala Lumpur in one shot without the need to charge along the way,” said Mr Koh.

Mr Koh Jie Meng, who has been driving an electric vehicle since 2019, said he now has no doubts about the feasibility of owning one, even as an HDB dweller. (Photo: TODAY/Ooi Boon Keong)

Drivers like Mr Koh have learnt that driving an electric car in Malaysia can be challenging given that the country still lacks the infrastructure that supports electric vehicles usage en masse.

There are only around 300 electric charging points across the country, with most of them concentrated along the west coast and the Klang Valley.

Furthermore, these drivers are also aware that there are not enough workshops or repair services specific for electric vehicles in Malaysia, in case urgent work is needed.

However, they note that the situation has improved recently and there is optimism that travelling with an electric car for a road trip in Malaysia could be a more viable option in the future.

MORE CHARGING POINTS IN KL, NORTH-SOUTH EXPRESSWAY

Mr Shahrol Halmi, president of the Malaysian Electric Vehicle Owners Club (MyEVOC), told CNA that the charging situation has improved vastly along the west coast from when he bought his car four years ago.

“When I first got the car, it was kind of pathetic – the kind of DC rapid charging infrastructure outside of Kuala Lumpur. So you fast forward to this year, actually there are already a pair of 50kW DC chargers in operation in Ayer Keroh Rest Stop, both north and south bound,” said Mr Shahrol.

Direct current (DC) charging points are fast charging, and typically takes an hour to charge a car fully. Alternating current (AC) charging points could take up to eight hours.

Mr Shahrol bought his electric car, a Tesla S 75, in 2017. He is based in Kuala Lumpur but has used the car to travel across various parts of Peninsular Malaysia.

He noted that of the estimated 300 charging points in the country, only a handful are DC points, and these are mainly concentrated on the west coast of the peninsula.

He lauded the move by local company JomCharge, which announced last October that DC chargers will be installed at various points along North-South Expressway to reduce range anxiety for electric car drivers travelling between major cities like Johor Bahru, Melaka, Kuala Lumpur and Penang.

Shahrol Halmi charging his Tesla S 75 at a DC charging point in Ayer Keroh. It costs RM1.20 per minute to charge the car. (Photo: Shahrol Halmi)

Besides the chargers at Ayer Keroh rest stop in Melaka, JomCharge is also set to install DC fast charging points at rest and relaxation (RnR) pitstops in Skudai, Johor as well as Bukit Gantang, near Ipoh, Perak.

Mr Shahrol said: “For Singaporeans who want to come to Malaysia for a road trip or holiday, there are charging points along the way for their electric cars. If they want to head to KL, Ayer Keroh is conveniently located mid-journey. There are absolutely no issues.”

He added that in Kuala Lumpur, there are currently three DC charging points, with two more set to be built soon.

READ: Budget 2021 – More incentives to encourage early adoption of electric vehicles

A Singaporean driver who made regular road trips to Malaysia, Lee Hon Sing, expressed surprise at how little money he had to spend charging his car during the trips.

“In KL, the fast chargers are free to use. Even the chargers at my hotel, near Sunway Lagoon, were free as well,” he said.

The IT programmer owns two electric cars which he uses for these trips – a Hyundai Kona and a Renault Zoe.

Before the borders were closed due to the COVID-19 pandemic, Mr Lee drove his Hyundai Kona, which is a long-range car, to Kuala Lumpur.

On paper, his car had enough range to complete the journey without recharging but he was worried and decided to charge at Ayer Keroh just in case.

“It is possible to drive the car from my house near Jurong area to Kuala Lumpur. But the first time I did it, I was a bit scared,” said Mr Lee.

“I did a top-up at Ayer Keroh for 40 minutes. But when I reached KL, I did my calculations and figured out that even if I did not top up, I would have had 80km of distance to spare. So it’s actually quite safe, and the range balance is comfortable,” added the 57-year-old.

An AC charging station at IKEA Tebrau in Johor. (Photo: Koh Jie Meng)

Mr Shahrol shared that the MyEVOC community has also extended advice and help to Singapore drivers who have planned road trips with their electric cars.

“I remember in 2019 a Singaporean guy was driving a 20kW (Hyundai) Ioniq up to KL. He needed to charge along the way so we were guiding him. I think he eventually stopped in Seremban for a charge, some of us were ready to go there and help,” he said.

“But fast forward to this year onwards, it’s pretty easy for any electric car to come up to Kuala Lumpur by fast charging at Ayer Keroh,” added Mr Shahrol.

ROAD TRIPS TO THE EAST COAST “A BIT OF A GAMBLE”

For Singaporean electric car owners who want to drive to Johor Bahru over the weekend when the border reopens, Mr Koh said a two-hour to three-hour congestion at the Causeway would only reduce the battery life by around 3 per cent if the driver sets the air-conditioner at full blast.

If drivers need to charge their cars, he pointed out that there are AC charging stations located at IKEA Tebrau, a popular shopping destination for Singaporeans.

Mr Shahrol also noted that most of the hotels in Desaru Coast, a popular beach holiday destination, have charging points for electric cars.

However, there needs to be more DC charging points across the country, especially on the east coast of Peninsular Malaysia, he added.

Road trips to the east coast could be risky as there are barely any charging points, he said.

“For trips to the east coast like Terengganu and Kuantan (in Pahang), Kelantan, it’s still a bit of a gamble, because there are only a few AC charging stations at some of the hotels in that area. It does require a bit more work, a bit more planning,” said Mr Shahrol.

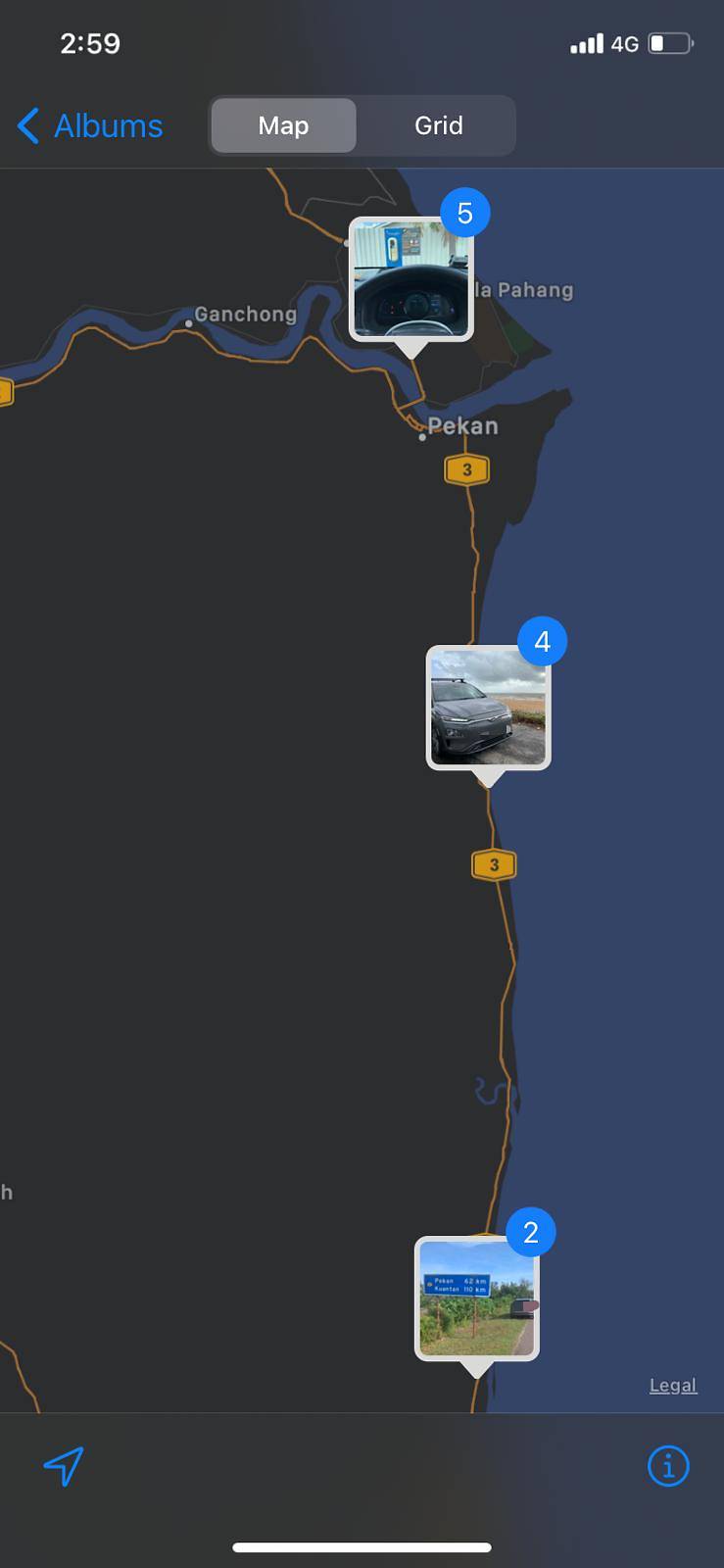

Driving along the east coast of Peninsular Malaysia requires planning. (Screenshot: Koh Jie Meng)

Mr Koh recalled that he once drove his Hyundai Kona from Singapore to Kuantan, a 340km journey on the east coast.

He knew that there were no DC chargers along the journey so he would not recommend that route for drivers.

“My (Hyundai) Kona is a long-range car so it had enough to complete the journey, there was also enough charge to overtake trucks along the way,” said Mr Koh.

This DC charging station installed at ABB Malaysia’s headquarters in Subang Jaya is free to use. (Photo: Koh Jie Meng)

However, he had to travel inland the following day to Subang, near Kuala Lumpur, to charge his car fully at a DC point before heading back home.

“When I arrived in Kuantan, I charged the car at my friend’s landed house for a bit. The next day, I drove to Subang for a fast charge,” he added.

LACK OF REPAIR OPTIONS

Besides charging points, another factor that triggers anxiety for electric car drivers is the lack of repair options if things go wrong.

Mr Shahrol, the MyEVOC president, said that in case of breakdown or repair, there are merely “one or two” workshops in Kuala Lumpur that are able to resolve EV repair issues.

“For such services, it’s still quite early yet (for Malaysia). Only these workshops are good at repairing EVs and they know not to mess things up when they look at it,” he added.

Over the last four years, Mr Shahrol has had to send his Tesla S 75 to Hong Kong twice for warranty repair claims, after encountering issues with his central screen.

Although the costs were covered as his car was still under warranty, he maintained that it would be more convenient if Malaysia had a Tesla workshop, or other electric car specialised workshops.

“It’s just the inconvenience of loading it up into a container, going over there, servicing it, repairing it and transporting it back,” said Mr Shahrol.

However, both Singapore drivers Mr Koh and Mr Lee said they have been lucky so far, and not experienced any breakdown or issues with their cars while travelling in Malaysia.

Mr Koh said: ”One thing that Malaysia doesn’t have is workshops to repair the EVs. So if anything happens, you have to tow it back to Singapore on a flatbed.”

READ: IN FOCUS – Thailand poised to be regional leader in electric vehicle revolution, and all it needs is a spark

Mr Lee recalled that he was involved in an accident, when his Kona was rear-ended by a Malaysian vehicle at a traffic light in Johor Bahru.

“When it happened, my first immediate thought was I now need to get a flatbed truck to tow it back to Singapore and it’s going to really cost me,” said Mr Lee.

He said that his car survived the hit, and only suffered a small dent. Thankfully, he could still drive the car to the police station to make a report and subsequently back to Singapore.

According to a transport expert CNA spoke to, Malaysia does not have electric vehicle repair facilities because there is a lack of human capital to support the EV industry.

Associate Professor Muhammad Zaly Shah, director of Universiti Teknologi Malaysia’s Centre for Innovative Planning and Development told CNA: “We don’t have programmes to train mechanic and engineers to be efficient in maintaining electric vehicles. So owners have to send their car back to manufacturers overseas.”

“Addressing the manpower with the right technological know-how is a critical issue to support the EV industry,” he added.

MORE CAN BE DONE TO BOOST EV TAKE-UP

Although purchasing an electric car would be more expensive that a petrol car, Mr Shahrol said a handful of Malaysians still prefer going electric because of the smoother driving experience.

“The biggest difference (between EV and petrol) is there’s no engine vibration, and you couple that with the fact that the torque of the motor is maximum when you start from standstill,” said Mr Shahrol.

“This means that when you push down the accelerator in heavy traffic, the car glides silently, so you can enjoy podcasts and music,” he added.

Based on May 2019 data, there are 194 battery EVs registered in Malaysia. In comparison, there are 1,274 registered electric cars in Singapore as of Jan 31 this year, according to the Land Transport Authority.

Mr Shahrol said “more can be done” to make EVs a more viable choice for drivers in Malaysia, such as introducing tax incentives and making more infrastructure available.

He expressed concern that Malaysia is in danger of being left behind by neighbouring countries like Singapore and Thailand, which are staking out bold pledges to transition from internal combustion engine cars to electric.

“Malaysia launched its electric mobility master plan in 2015, which set targets for 2020 and 2030 and we’ve fallen way short of that. We are trying to tell the government that our neighbours are progressing, not only in helping users but also manufacturing, while we seem to be taking a wait and see attitude,” said Mr Shahrol.

“So enough of the waiting and seeing. Let’s get going,” he added.

Driving along the east coast of Peninsular Malaysia rewards drivers with picturesque views. (Photo: Koh Jie Meng)

Mr Shahrol said one positive sign is that Malaysia’s Ministry of Environment and Water is set to launch a low carbon mobility action plan in 2021.

“We look forward to that, hopefully there’s some positive news in terms of charging stations, more tax incentives for buying electric vehicles – the usual stuff that we have seen by governments in the region and around the world,” he added.

However, Assoc Prof Muhammad Zaly wondered if the Malaysia government would simply back the transition given that the electric vehicle industry could be seen as threatening the future of government-owned oil and gas company, Petronas.

He added that local car manufacturers Proton and Perodua have also yet to produce electric cars.

He observed that policymakers must be seen to support firms like Petronas, Proton and Perodua to ensure they remain competitive in the automotive industry.

“If (policymakers) want these local companies to survive, they must maintain petrol cars as the main option for users. If they transition to EV, Proton and Perodua cars would no longer have an edge over other brands,” said Assoc Prof Muhammad Zaly.

He also maintained that Malaysia’s position as the second-largest oil and natural gas producer in Southeast Asia would mean that it could stand to lose if more countries transition to EV.

“The cost of petrol or diesel is relatively cheap in Malaysia, so even users would hesitate to switch their diesel or petrol-powered vehicles to electric,” he added.

Utilities to build network of EV charging stations

The utility supplies electricity and natural gas to more than 7 million customers in 16 states, including Virginia, where it is headquartered.

Drivers are increasingly purchasing and putting electric vehicles on roads. The Edison Electric Institute reported 1 million electric vehicles on U.S. roads in 2018. The institute estimates there will be more than 18 million EVs on the roads by the end of the decade.

Proponents hope a more extensive web of charging stations will enable speedier, longer-distance travel via electric vehicles.

Adding the fast chargers — which can charge an electric vehicle to 80 percent in about 20 to 30 minutes — is a must for that, the coalition said.

The companies plan to install fast chargers in safe and well-lit areas. Putting them near amenities such as restaurants is ideal, Staples said. Sites along interstates and frequently traveled secondary roads and near highway-accessible places are also good, she added.

The coalition does not yet have an exact number of charging stations it aims to build as part of the project, Staples said.

Dominion itself plans to install and own four fast-charging stations in 2021. Such stations are site-specific, Staples said.

The cost to build one station is in the range of $50,000.

The company also plans to give rebates to customers such as restaurants, service plazas and retailers that applied to install, own and operate 30 fast-charging stations. The rebates will help cover the cost of the chargers and installation.

As the market for electric vehicles evolves, the six companies will determine whether it’s necessary to install additional chargers.

“We want to make sure we’re complementary with other companies that are installing charging infrastructure,” Staples said.

Endeavors to ramp up EV charging station infrastructure are also happening in other parts of the U.S.

Midwest utility companies DTE Energy and Consumers Energy got involved last year in an effort to install a network of fast charging stations from Michigan to Kansas.

In 2018, a dozen states along the Eastern Seaboard signed up to coordinate with each other on building EV charging stations.

UK Government To Spend £20 Million Funding ‘Electric Vehicle Innovations’

The government has announced plans to invest £20 million in “electric vehicle innovations” and it’s inviting companies to pitch their ideas. The news comes as the government “cements” its commitment to ending the sale of new petrol- and diesel-powered cars in 2030, with sales of new hybrid cars ending in 2035.

According to the Department for Transport (DfT), the new research and development investment is designed to help make the UK a world leader in electric vehicle (EV) design and production. It’s also intended to “help the UK transition towards all new cars and vans being zero emission by 2035”, as part of the government’s ‘build back greener’ policy.

The government appears not to have set ideas in mind, but is inviting companies and researchers across the country to pitch their ideas to the DfT. New charging technology, zero-emission vehicles and even ways of making the production and disposal processes greener are all on the menu.

It isn’t the first time the government has offered such funding, with investments made in projects including a hydrogen-powered ambulance for London. That vehicle, designed by ULEMCo for the London Ambulance Service, can reach speeds of up to 90 mph and can travel 200 miles a day with no CO2 emissions.

Similarly, the government has also awarded £3 million to start-up firm Urban Foresight, which came up with the idea of ‘hidden’ on-street charging points. The money is being used to develop the high-tech chargers, which rise out of the pavement to serve EV drivers without access to off-street parking.

“Innovations to increase the uptake of zero-emission vehicles will make our air cleaner while supporting innovative UK businesses,” said Simon Edmonds, the deputy executive chair and chief business officer of Innovate UK, a non-departmental public body tasked with supporting business ideas. “Innovate UK has played a crucial role in helping businesses bring their innovations towards reality and we urge those innovators with bright ideas to apply for this vital funding.”

Meanwhile Transport Secretary Grant Shapps said the funding would also help to create jobs, with the DfT estimating green transport could create around 6,000 skilled jobs over the next decade.

“Investing in innovation is crucial in decarbonising transport, which is why I’m delighted to see creative zero-emission projects across the UK come to life,” said Shapps. “The funding announced today will help harness some of the brightest talent in the UK tech industry, encouraging businesses to become global leaders in EV innovation, creating jobs and accelerating us towards our net-zero ambitions.”

One Bank Made Big Bets on Apple, Tesla, Nio, and Other EV Stocks

Text size

Norway’s central bank drastically increased investments in Apple stock, and electric-vehicle makers Tesla, Nio, Nikola, Li Auto, and Xpeng.

Mladen Antonov/AFP via Getty Images

The central bank of Norway drastically increased investments in the maker of iPhones, and in shares of the makers of electric vehicles as 2020 wound down.

In the fourth quarter, Norges Bank, which administers the world’s largest sovereign-wealth fund, bought shares of

Apple

(ticker: AAPL),

Tesla

(TSLA),

NIO

(NIO),

Nikola

(NKLA),

Li Auto

(LI),

Xpeng

(XPEV), and

Fisker

(FSR). The latter four investments represent new holdings for the bank.

Norges disclosed the stock trades, among others, in a form it filed with the Securities and Exchange Commission. It declined to comment on the investment changes.

Its latest balance sheet, covering January, shows the bank had $1.36 trillion of assets, including the $1.27 trillion in assets of the Government Pension Fund Global, as the country’s sovereign-wealth fund is known.

Norges bought 120.2 million more Apple shares in the fourth quarter, lifting its investment to 167.6 million. The Apple investment was the bank’s most valuable equity holding as of the end of 2020, according to Norges’ annual report.

Apple stock soared 80.8% in 2020, but it has slipped 8.8% so far in 2021 through Friday’s close. In comparison, the

S&P 500 index,

a measure of the broader market, rose 16.3% in 2020, and is up 5% year to date.

Apple stock, along with those of the EV makers, has been hammered in recent weeks by higher bond yields, which create an environment hostile to tech and growth stocks. Indeed, demand for the iPhone 12 has been strong, and investors are looking forward to the next model. Barron’s has noted that Apple’s dividend yield isn’t that enticing, but the company has been increasing the payouts at an impressive rate.

Norges bought 6.9 million more Tesla shares in the quarter to end the year with 7.8 million shares of the electric-vehicle giant. Tesla stock rocketed more than eight times in value last year, but it has veered to a 1.7% loss so far in 2021.

Tesla disclosed in February that it bought $1.5 billion of Bitcoin and intended to accept payments in the cryptocurrency. Tesla is known for its cars, but its operations in software, backup battery power, solar panels, and insurance are also valuable, as are its plans for robotaxis. The

ARK Innovation

exchange-traded fund had a spectacular 2020, partly because of its holdings in Tesla stock, but is seeing a muted performance this year, as well.

The bank bought 13.4 million NIO American depositary receipts in the fourth quarter, raising the investment to 13.7 million ADRs of the Chinese maker of EV vehicles.

NIO ADRs topped Tesla stock’s performance in 2020, surging more than 12 times in value. So far this year, NIO ADRs are 6.6% lower.

After large runups in their shares, NIO and the other Chinese EV makers have been caught up in the broader downturn for growth stocks, sending their ADRs tumbling. Disappointing sales guidance may have also hurt NIO ADRs.

Norges bought 17 million shares of Nikola, 1 million ADRs of Li Auto, 527,577 ADRs of XPeng, and 1 million shares of Fisker. It hadn’t owned any of those companies’ shares at the end of the third quarter.

Nikola stock soared after the maker of trucks powered by batteries and hydrogen fuel cells went public in early June via a special-purpose acquisition company, or SPAC. But shares slipped when the founder stepped down, and a deal with General Motors (GM) was scaled back.

Nikola stock ended the year with a 55% drop from the day the SPAC listing was completed. So far in 2021, Nikola stock has gained 11.5%.

Li Auto and Xpeng ended 2020 with respective gains of 251% and 286% from their summer initial-public-offering prices. Fisker rose 64%from its public listing via a SPAC in October. But in the new year, Li Auto and Xpeng ADRs have slid 10.9% and 17.9%, respectively.

Fisker stock, however, has surged 57%. A partnership with

Foxconn Technology

to jointly produce a vehicle has bolstered the shares.

Inside Scoop is a regular Barron’s feature covering stock transactions by corporate executives and board members—so-called insiders—as well as large shareholders, politicians, and other prominent figures. Due to their insider status, these investors are required to disclose stock trades with the Securities and Exchange Commission or other regulatory groups.

Write to Ed Lin at edward.lin@barrons.com and follow @BarronsEdLin

BMW MINI aims to be a purely electric vehicle brand from 2030

In 2030, MINI will be the first brand of the BMW Group to be converted entirely to electric drive. While the Munich-based company has so far not wanted to commit to specific annual figures for the end of the combustion engine at BMW or Rolls-Royce, according to a report there will be an end date for the small car brand MINI from next week.

The report claims, BMW boss Oliver will be Zipse announce the end of combustion engines at MINI at the balance sheet press conference next week.

Mini will follow other prominent carmakers like Jaguar and Volvo in revealing its plans to go fully electric in near future. Tesla’s increasing valuations, which has gone up in leaps and bounds in recent times, has accelerated carmakers’ shift towards electric mobility.

The message to go fully electric was somehow hidden in the announcement that the last new MINI with a combustion engine will celebrate its market launch in 2025. From then on, MINI aims to move in quick succession to adopt complete electrification of its cars.

As early as 2027, 50 percent of MINI sales should be all-electric cars, before fully electric fleet three years later. The success of the electric MINI , built together with Great Wall in and for China, which is known to celebrate its market launch as early as 2023, will be essential for this.

A few months ago BMW officially announced that MINI would be electrified to a much greater extent in the next few years. The sports car brand John Cooper Works will soon be switched to electric. An electric car with the brute aerodynamics of the MINI JCW GP is already doing its laps on the Nurburgring Nordschleife and should soon prove that it can also achieve high levels of driving dynamics.

The core brand BMW will also become increasingly electric in the next few years, but in all probability there will still be new cars with petrol or diesel engines after 2030. The same applies to Rolls-Royce , but of course the luxury brand from Goodwood has long been thinking intensively about a future without local CO2 emissions. The technology for this is to be provided by the BMW i7, with which the Munich-based company intends to roll silently and cleanly onto the electric luxury sedan market at the end of 2022.