EVs, Lucid, BMW, Kia And Hyundai Dominate World Car Of The Year Finalists Forbes

Electric Vehicles

Evergrande, EV unit shares jump after chairman signals business shift

A traffic light is seen near the headquarters of China Evergrande Group in Shenzhen, Guangdong province, China September 26, 2021. REUTERS/Aly Song/File Photo

HONG KONG, Oct 25 (Reuters) – Shares in China Evergrande Group (3333.HK) and its EV unit rose on Monday as the embattled property developer moved to prioritise growth of its nascent electric vehicles business over its troubled core real estate operations.

Evergrande, reeling under more than $300 billion in liabilities, averted a costly default last week with a last-minute bond coupon payment, buying it more time to head off a looming debt crunch with its next major payment deadline on Friday. read more

An announcement by its chairman, Hui Ka Yan, reported by state media on Friday, that it would make its new electric vehicle venture its primary business, instead of property, within 10 years, cheered investors on Monday.

Evergrande rose as much as 6% while China Evergrande New Energy Vehicle Group Ltd (0708.HK) as much as 17%, although both later trimmed their gains. The benchmark Heng Seng Index (.HSI) climbed 0.1%.

Raymond Cheng, CGS-CIMB Securities’ head of China research, said the business shift makes sense given Beijing’s growing support for EVs and its increased tightening of the frothy real estate sector.

“This is the best outcome, if it just focuses on existing developments and maintains the operation,” Cheng said.

While the move would help Evergrande deleverage by gradually scaling down its massive landbank, Cheng said it was unclear how the it would affect the company’s asset disposal plan.

Evergrande’s new vehicle business, founded in 2019, has yet to reveal a production model or sell a single vehicle. Last month, the unit warned it was still seeking new investors and asset sales, and that without either it might struggle to pay salaries and cover other expenses.

Hui expects property sales will slow to about 200 billion yuan ($31.31 billion) per year within the 10-year period, compared to more than 700 billion yuan last year, China’s Securities Times reported on Friday.

NEXT HURDLES

News late last week that Evergande had averted a default by securing $83.5 million for the last-minute payment of interest on a bond has lifted confidence the company may be able to avoid a messy collapse that would have significant ramifications for global financial markets.

On Monday, sources told Reuters some bondholders had received coupon payments they were owed last week, which suggested debt problems were being addressed.

Evergrande next needs to find $47.5 million by Friday and has nearly $338 million in other offshore coupon payments coming up in November and December.

Broader concerns about China’s real estate sector, which accounts for a quarter of gross domestic product, still loom large for investors and policymakers in the world’s second-largest economy.

Property firms, including many with dollar-denominated debts, will meet with China’s state planner in Beijing on Tuesday, media outlet Cailianshe said.

Evergrande separately said on Sunday it had resumed work on more than 10 projects in six cities including Shenzhen. Many of its projects across the country had been halted due to payments owed to suppliers and contractors. read more

Also lifting general confidence, state media outlet Xinhua in an article on Monday said the spillover effect of Chinese real estate companies’ debt default risks to the financial industry would be controllable. read more

The report follows comments from senior officials including Vice Premier Liu He and central bank governor Yi Gang last week, who also said property companies were facing debt default issues due to poor management and a failure to adjust to market changes. read more

Reporting by Clare Jim and Donny Kwok; editing by Richard Pullin and Sam Holmes

Our Standards: The Thomson Reuters Trust Principles.

The bumpy road to India’s electric car revolution

India’s car buyers are fussy – aspirational but cautious with spending. It’s why Maruti, India’s biggest car maker, has made no move to launch an electric car, saying the prices are still too high. It’s also why foreign brands have struggled to crack the market, and have even shut shop. Ford announced last month that it would stop making cars in India, even as it invested $11bn in electric vehicles in the US.

Hamilton Accelerating Electric Vehicles Charging at Home, Public Locations – TAPinto.net

Fairfax supervisors may offer another incentive for electric vehicles | news/fairfax

Fairfax County supervisors on Oct. 19 directed the county’s Department of Land Development Services to analyze the possibility of waiving permitting fees associated with installation of electric-vehicle infrastructure.

The intention is to reduce barriers to switching to environmentally friendly alternatives, said Chairman Jeff McKay (D), who presented the proposal as a joint board matter with Supervisor Daniel Storck (D-Mount Vernon).

The Fairfax County community is working collectively towards net-zero energy and carbon-emissions reductions, McKay said. With electric vehicles becoming more popular, county officials should ensure there are sufficient resources and infrastructure available for community members, he said.

Electric vehicles require that additional infrastructure be built into existing facilities, which can present a major hurdle for residents seeking to switch to gas-alternative vehicles, McKay said.

Permitting fees can impose a financial burden and discourage environmentally sustainable actions, he said. “The climate crisis is now,” McKay said.

“We do not have time to wait on actions that can improve our carbon emissions and resiliency towards a changing environment.” The Department of Land Development Services’ fee-waiver analysis will include both commercial and residential properties.

Staff will report back to the board on the feasibility of a fee waivers no later than February 2022.

“We want to look for every opportunity to incentivize and support the transition” to electric vehicles, Storck said. “I think this is a good way to at least understand what our options are.”

Xpeng launches flying car that can also operate on roads

HT Aero, an affiliate of Chinese electric carmaker Xpeng Inc., launched a new vehicle capable of flying in the air and driving on roads. The launch of HT Aero’s 6th–generation model happened at the Xpeng Tech Day on Sunday, October 24, 2021.

Xpeng

GUANGZHOU, China — HT Aero, an affiliate of Chinese electric vehicle maker Xpeng Inc., launched a new flying car on Sunday that it says can also drive on roads.

The company says it plans for a rollout in 2024. The car is not commercially available right now. And HT Aero said the final design might change.

HT Aero’s vehicle will have a lightweight design and a rotor that folds away, the company said. That will allow the car to drive on roads and then fly once the rotors are expanded.

The vehicle will have a number of safety features including parachutes, the company said.

HT Aero is backed by Xpeng and its founder He Xiaopeng. The company raised $500 million last week from a number of outside investors including high-profile venture capital firms.

Flying cars — also called electric vertical take-off and landing vehicles — have garnered a lot of interest from automakers and start-ups.

However, there are a number of challenges for these vehicles to become wide-scale including regulation and safety issues.

HT Aero’s new land and air vehicle was launched at Xpeng’s Tech Day where the company also took the wraps of the latest version of its advanced driver assistance system called XPILOT 4.0.

Charlottesville holds its first electric vehicle showcase

CHARLOTTESVILLE, Va. (WVIR) – A showcase in Charlottesville is a driving force in helping to reduce the effects of climate change.

The Silk Mills Building hosted Charlottesville’s first ever electric vehicle showcase on Saturday afternoon. The Silk Mills Building worked with the Community Climate Collaborative to put on the event.

It featured 16 different vehicles, including nine different models. There was also a range of affordable cars.

“It’s a key element in reducing CO2 emissions and in combating climate change,” owner of the Silk Mills Building, Martin Chapman said. “Since that is the most existential threat at the moment, the more people that switch to EVs, the better it’s going to be for the climate and everybody.”

Though this was the first showcase, the event organizers say they hope to hold another one in the spring.

Copyright 2021 WVIR. All rights reserved.

Do you have a story idea? Send us your news tip here.

Sixt offers travellers choice of hybrid and electric vehicles – Business Traveller

Munich-based car rental and ride-hailing firm Sixt will now allow travellers to choose a hybrid or electric vehicle when booking a transfer or limousine service.

The sustainable, CO2-efficient models are available in the UK as well as several other European cities across France, Germany, Italy, the Netherlands, Spain, Sweden, Switzerland and Turkey.

These include London, Crawley, Edinburgh, Farnborough, Gatwick, Glasgow, Guildford, Heathrow, Luton, Oxford and Reading in Great Britain; Paris, Essonne, Seine-et-Marne, Vexin and Yvelines in France; Berlin, Dresden and Munich in Germany; Milan in Italy; Amsterdam in the Netherlands; Barcelona in Spain; Stockholm in Sweden; Zurich in Switzerland; and Istanbul in Turkey.

Customers can now select the hybrid or fully electric vehicles when booking trips online or via the Sixt app.

Sixt offers customers worldwide a network of taxi, limousine and ride services, with the app offering worldwide access to a fleet of over 200,000 vehicles.

As part of the launch, customers can receive a £10 discount on the total fare when using the voucher code GREEN10 to book a ride in the categories Green, Business Green and Business Green XL (until the end of November).

Melanie Wand, Executive Director of Sixt ride Operations, commented:

“By integrating a hybrid and fully electric vehicle range in SIXT ride, we offer our customers a CO2-reduced option for transfers during holidays, on business trips or in everyday life thus taking a further step towards a comprehensive, sustainable range in the interests of our customers. We see a rise in demand for electromobility in the market and are pleased to be able to meet this with our ride service. Once again, we are putting our customers’ needs at the heart of everything we do at SIXT.”

Last month the firm announced plans to pilot a new driverless “robotaxi” service in the Bavarian capital in 2022.

Where Will Nio Be in 5 Years?

There are several new entrants in the electric vehicle manufacturing space, and figuring out which one of these will succeed in the long run can be quite challenging. EV start-ups that plan to begin production a year or two from now could be particularly risky investments, because there will be quite a few suppliers of electric vehicles by the time these companies enter the market. By comparison, early movers may have more time to establish themselves.

One such company is Nio (NYSE:NIO). Let’s take a closer look at how Nio may fare in the long-term.

Impressive sales growth

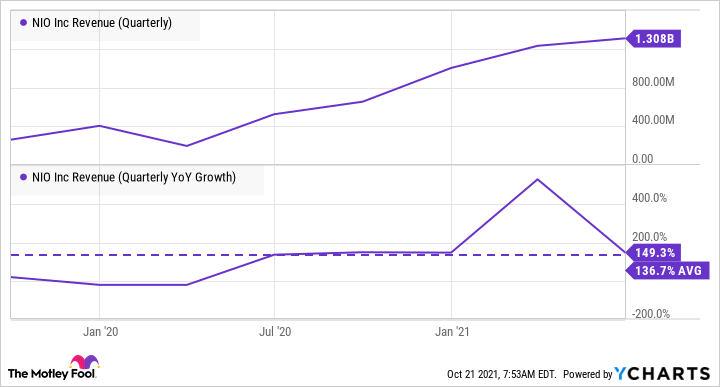

Founded in 2014, Nio sold 24,439 vehicles in the third quarter. That represents 100.2% growth over the company’s year-ago quarter deliveries. In the last two years, Nio has grown its quarterly revenue at an average rate of nearly 137%.

In September, Nio delivered 10,628 vehicles, up 125.7% year-over-year, despite ongoing supply chain constraints. Its 2020 annual revenue and deliveries more than doubled compared to 2019.

NIO Revenue (Quarterly) data by YCharts

Nio does not provide a long-term expected growth target, but Nio should be in a good position five years from now, even if the growth rate falls a bit from its historical levels. Wall Street analysts expect the company’s sales to grow to $13.6 billion in 2024, up from $2.3 billion in 2020.

Strong domestic and global demand for EVs

Electric vehicles are expected to see robust demand growth in the coming years. Supportive governmental policies, falling EV production costs, improved performance, and the development of charging infrastructure are some of the factors supporting the growth of electric vehicles. And while electric vehicles are witnessing higher demand globally, China leads in terms of growth.

According to Canalys, global EV sales grew 160% in the first half of 2021. Out of the 2.6 million EVs sold globally in the first half of the year, 1.1 million were sold in China. New EV sales in China in the first half of 2021 were nearly equal to EV sales in the country in all of 2020.

Image source: Getty Images.

China’s EV sales in the first half of 2021 represented 42% of the global EV sales in that period. So Nio could benefit from strong demand for EVs in its domestic market.

After China, the fastest-growing market for EVs is Europe. Roughly 1 million EVs were sold in Europe in the first half of this year. Nio is eyeing that market too. Norway leads in the adoption of electric vehicles, and roughly 80% of new car sales in the country are EVs. Nio completed the delivery of its first batch in Norway in September. Over time, the company plans to enter other European markets as well.

Nio faces stiff competition

Though Nio’s revenue growth has been impressive so far, the company faces stiff competition from other players. In China, a joint venture between SAIC Motor, General Motors, and Liuzhou Wuling Motors controls the highest share of the electric vehicles (including hybrids) market. Another key competitor is large traditional automaker BYD, which is expanding into the EV segment.

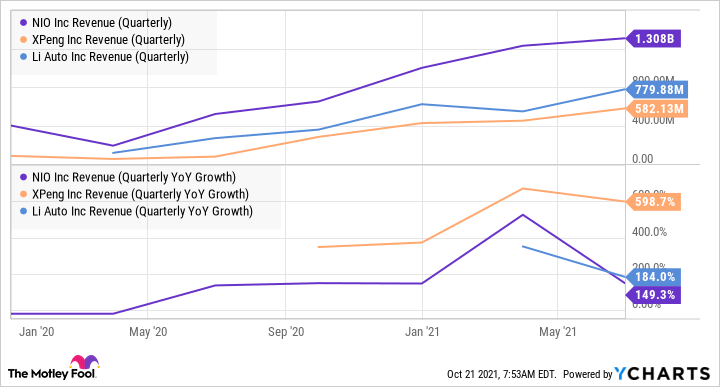

Smaller players, including XPeng (NYSE:XPEV) and Li Auto (NASDAQ:LI), also offer some serious competition. XPeng reported much stronger revenue growth than Nio in the last four quarters, though from a much lower base.

NIO Revenue (Quarterly) data by YCharts

Finally, established EV maker Tesla is a top player in China’s EV market, and offers significant competition to Nio.

In short, despite strong expected demand growth for EVs in the coming years, the road for Nio’s growth won’t be easy.

A promising stock

Despite competition, Nio has fared well so far. As more and more automakers launch their EV models, competition in the segment will heat up further. But Nio is taking several steps to continue growing in the long-term. Its Battery-as-a-Service model, for example, allows customers to buy a car without a battery and subscribe for battery packs later.

Another way in which Nio plans to expand its addressable market is by developing low-priced models for price-sensitive customers. Strong demand, solid growth strategies, and the company’s plans to expand in the European market should help drive Nio’s growth in the next five years, and beyond.

This article represents the opinion of the writer, who may disagree with the “official” recommendation position of a Motley Fool premium advisory service. We’re motley! Questioning an investing thesis — even one of our own — helps us all think critically about investing and make decisions that help us become smarter, happier, and richer.

Poor EV take-up to cost Australia’s health system $1tn by 2050, modelling shows | Electric vehicles

Australia may be left with almost a $1tn health bill by 2050 if it doesn’t boost the take-up of electric vehicles, according to a new report released on Sunday.

But this could be slashed in half by setting an ambitious target to convert every car in the country to electric by 2035.

The modelling was released by the Australian Conservation Foundation (ACF), which commissioned accounting firm Deloitte to examine the community benefit from increasing the uptake of electric vehicles (EVs).

A “bespoke economic model” was used to examine three scenarios: whereby Australia achieved net-zero road transport emissions in 2035, 2040 and 2050. These scenarios compared the cost of air, noise, water and greenhouse gas pollution caused by petrol- and diesel-powered cars, and those of EVs.

Petrol cars contribute heavily to air, noise and water pollution through the particles emitted from the exhaust and through the waste grease, oil and rubber needed to run them. By contrast, electric vehicles have fewer components and more efficient motors.

As this pollution leads to illness, the cost ends up being borne by the health system.

The report found that under the “business as usual” scenario – where nothing is done to support uptake – costs will mount to $864.9bn by 2050, with air pollution alone amounting to $488.2bn.

New South Wales and Victoria will bear the brunt as the most populous states, with costs mounting to $257.7bn and $203.6bn respectively. On a per-capita basis, the combined use of private transport and freight was greatest in Western Australia, where the cost was $43,900 per person.

However, in a scenario where EVs made up 26% of the private car fleet by 2030 and 100% by 2050, Australia would avoid $233bn in costs. A more ambitious scenario where a 28% share is achieved by 2030 and full uptake in 2045 would see $335bn in costs side-stepped.

A rapid transition of the entire private car fleet to EV by 2035, when coupled with better public transport systems, would see $492bn in costs avoided.

Sign up to receive an email with the top stories from Guardian Australia every morning

Dr Eamon McGinn, a partner at Deloitte Access Economics, said while these figures were broadly understood among government departments, they are “not front of mind” for many people.

“We create invisible, unborne costs whenever we go driving. Obviously we pay for fuel and the maintenance, but there are these additional costs we impose on our neighbours and our community,” McGinn said.

“We think about petrol costs, we think about getting stuck in traffic. We don’t necessarily think about the noise, or the pollution coming out the tailpipe or the damage to waterways.”

Matt Rose, ACF’s economy and democracy program manager, said the report was unique in that it sought to measure the cost of inaction.

“Transport emissions are the second-largest source of emissions in Australia and they’re growing,” Rose said. “There is a cost to not moving and this shows what those costs are in our built-up city areas.”

The report assumed that all EVs would be powered entirely by renewable energy and obtained its data from the Bureau of Infrastructure and Transport Research Economics, and Australian Transport Assessment and Planning guidelines.

The honorary secretary of Doctors for the Environment, Dr Richard Yin, said independent research suggested the combined pollution from coal-fired power and internal combustion engines caused 5,000 deaths a year, with some studies finding the cost to the health system running as high as $24bn a year.

“It’s a ginormous hidden cost,” Yin said. “Worldwide for example, there were 8 millions deaths globally in 2018. That’s a year.”

While the goal should be for all electric vehicles to be entirely powered by renewable energy, Yin said there were still benefits even where the power was drawn from coal.

“There are advantages even if you are sourcing power from coal-fired power stations because the vehicles are more efficient,” he said. “The benefits are just multiplied when we transition to renewable energy and get rid of coal-fired power stations as well.”