The Electric Vehicle Experience show huge success this weekend CKPGToday.ca

Electric Vehicles

Why Foreign Investors Should Invest in Indonesia’s Electric Vehicle Market

Opinions expressed by Entrepreneur contributors are their own.

Electrical vehicles (EV) are becoming increasingly popular in the worldwide automotive industry, and Indonesia is no exception. The Indonesian government is leaving no stone unturned in order to promote the growth of the country’s electric vehicle sector by opening up new investment options for companies from across the world.

Foreign EV firms interested in setting up a company in Indonesia can now benefit from more relaxations after President Joko Widodo introduced the new Presidential Regulation 55/2019 to accelerate EV implementation for public transportation.

Here are four reasons why foreign investors should consider investing in this sector.

Abundant natural resources

When it comes to producing electric car batteries, nickel is considered to be a critical component. Indonesia has one of the greatest deposits of nickel in the world. A quarter of the world’s known nickel deposits are found in Indonesia. In 2020, Indonesia generated 760,000 tons of nickel, totaling 21 million metric tons of nickel reserve in the country.

Moreover, in addition to holding the largest gold reserve, Indonesia’s Grasberg mine holds the world’s second-biggest copper reserve, which is essential for building EV batteries.

Related: Is Ideanomics a Good Electric Vehicle Stock to Add to Your Portfolio?

Indonesia EV roadmap

With a $17 billion road map, Indonesia has ambitious plans to become a significant participant in the global electric vehicle industry. By 2025, the goal is to have 2.1 million electric motorbikes and 400,000 electric vehicles on the road, with 20% of them being locally produced. One of its goals is to create an all-electric bus fleet in less than seven years for Jakarta’s metropolitan mass public transit system. Moreover, 14,000 electric buses are needed to reach that goal.

In addition, PLN, the state-owned power company, has committed to installing more than 31,000 additional EV charging stations by the year 2030. To meet this commitment worth $3.7 billion over 10 years, PLN has made it available for the commercial and public sectors to invest in Indonesia. Moreover, several government initiatives are underway to develop electric vehicle capabilities. This bodes well for firms that are involved in the development of electric vehicles.

As a result of the government’s active participation in the Indonesian EV industry, investors appear to feel protected.

As of late July, South Korean giants, Hyundai and LG, have already signed a Memorandum of Understanding (MoU) with the Indonesian government to incorporate a joint venture company focusing on EV battery production in Karawang, West Java. This $1.1 billion investment company aims to produce over 150,000 batteries for EVs every year.

Indonesia EV market is young and growing

Indonesia’s EV sector is still in its infancy, where electric vehicles only represent 0.2% of annual vehicle sales in 2019. However, in September 2020, the University of Indonesia found out that over 70% of Indonesians are interested in owning an electric vehicle, citing environmental concerns as the primary reason, indicating that Indonesians are more aware of EVs.

McKinsey also projected that Indonesia’s EV sales will increase significantly in the coming years. By 2030 electric passenger car sales in the country are expected to reach 250.000 units, or 16% of all new passenger car sales, while demand for electric motorbikes is predicted to reach 1,9 million units, representing 30% of all new two-wheeler sales.

As the home to over 22% of the world’s nickel deposits, coupled with the government’s initiatives to reduce emissions by 29% over the next decade, the country has created an ideal climate for EV producers to invest in Indonesia.

Related: Indonesia Rated the fastest-growing Internet Economy in Southeast Asia

Government-backed incentives in Indonesia’s EV sector

According to the government’s latest Positive Investment List, the Indonesia EV industry falls under priority sectors in Indonesia. Benefits like 100% business ownership and various tax incentives are acting as a catalyst in attracting investors across the globe. For instance, EV businesses with a capital investment of over IDR 500 billion will get a 100% deduction in corporate income tax, while investments worth IDR 100-500 billion will receive a 50% deduction in corporate income tax.

The culmination of all these factors has set the stage for foreign investors to invest in Indonesia’s burgeoning EV market.

Related: What Makes Indonesia the Fastest Rising E-commerce Country

Letters: Electric cars don’t necessarily mean sustainable transport

Overcoming suspicion

I have just read Shelley Scott’s letter to the editor about the Aug. 16 Q&A with Joe Keohane on his book, “The Power of Strangers: The Benefits of Connecting in a Suspicious World.” That same interview made me want to read the book, which I am now doing, and I am finding the ideas are enriching my life.

I understand Ms. Scott’s concerns about the dangers of speaking with strangers. I grew up in Chicago and lived in Boston. I have known uncomfortable confrontational moments, and the city tradition of not looking strangers in the eye. I am not deep into this book, and find it cannot be rushed. But in flipping ahead, I found a specific reply to her concerns on page 224, where Keohane says he understands that a tall white man could be treated differently and he isn’t suggesting anyone start, push, or continue in situations that make them uncomfortable. There may well be more replies in the book.

I find myself looking for ways to make simple contacts authentic and more meaningful, even if very quick. I now live in rural Maine, and recently at a restaurant I told two strangers (who asked) some good places to visit in my area. I felt a warmth in the conversation, and that it was more than just directions jotted on a paper napkin ring.

Marilyn Crowley

Harrison, Maine

EVs aren’t risk-free

The Aug. 30 cover story headlined “The electric car age: When will it arrive?” begs the question: Who is waiting for this so-called revolution and why? I would prefer to see an analysis of the pros and cons of transitioning to electric vehicles.

Unfortunately the mainstream press has largely avoided any discussion of the negative environmental impacts or national security implications of a technology that relies heavily on rare earth minerals and substances, like lithium, that are now sourced mainly from a few foreign countries.

Equally troubling is the common assumption that electric vehicles represent a cleaner, greener technology. But electricity is only as clean as the technology that produces it, a large part of which involves burning coal and other fossil fuels. And has anyone considered the capacity of the electrical power grid to accommodate such an increase in usage? This and many other questions need to be answered.

Jennifer Quinn

Gate City, Virginia

Sustainable mobility

The Aug. 30 cover story headlined “The electric car age: When will it arrive?” asks the wrong question. With 50% to 60% of U.S. urban areas dedicated to the personal vehicle (roads, parking, and driveways), we should be asking, “The sustainable mobility age: When will it arrive?”

Shifting to electric cars simply shifts the burden to the power grid, which still relies largely on burning coal and gas, and is vulnerable to power outages.

Electric cars do not resolve our community’s urgent social justice issues for those who cannot afford vehicles or who are unable to drive. They do not alleviate our growing urban heat islands and stormwater runoff, which are both exacerbated by climate change. And they do not solve our public safety issues to reduce pedestrian and cyclist deaths and injuries. We can choose a better path forward by de-emphasizing the role of the personal vehicle and prioritizing other modes of mobility.

Catlow Shipek

Tucson, Arizona

DEP rolls out plan to drive more electric vehicles to dealers’ lots in Pa. | News

PITTSBURGH (TNS) — Pennsylvania is rolling out a plan to give car buyers better access to electric cars and trucks without having to travel to neighboring states to find more plug-in options on dealers’ lots.

With a draft rule released by the Department of Environmental Protection, the commonwealth is aiming to join a growing list of states in a program led by California that requires a portion of light-duty auto sales to be zero-emission vehicles — electric, plug-in hybrid or hydrogen-powered cars and trucks.

DEP officials expect the rule to spur a modest boost in clean car sales. Now, electric vehicles make up about 1% to 2% of new car and truck sales in Pennsylvania. The program is expected to raise that to between 6% and 8% when it would take effect in 2025.

”This is not only an environmental benefit, but it’s a consumer choice benefit,” Mark Hammond, director of DEP’s Bureau of Air Quality, said at a regulatory advisory board meeting on Thursday.

The 13 states that participate in the zero-emission program — including neighboring states New York, New Jersey and Maryland — get a disproportionate share of the electric vehicles sold in the U.S. because carmakers get credit for shipping cars there, DEP officials said.

That leaves a smaller inventory and fewer options for car buyers and dealers in states like Pennsylvania.

With the new program, Pennsylvania hopes to get more access.

Medium- and large-scale automakers would generate credits by sending electric cars to Pennsylvania for sale or could buy credits from other electric vehicle makers to meet their requirements. Fully electric vehicles would generate up to four credits, based on their range, while plug-in hybrids would generate about a credit or less.

The current program calls for zero-emission vehicle credits to make up 22% of vehicle sales in each participating state for model year 2025 and beyond. Because automakers can generate credits in multiple ways — and some cars are worth more credits than others — it is difficult to tell how many and which type of electric vehicles will be offered for sale, according to a report this year by the statewide nonprofit PennEnvironment Research and Policy Center.

PennEnvironment and other environmental groups have urged the Wolf administration to raise its electric vehicle ambitions.

President Joe Biden has set a target for half of all new vehicles sold in the U.S. in 2030 to be electric, which is generally in line with most major automakers’ goals of making electric vehicles 40%-50% of new car sales in 2030.

California’s governor has announced plans to phase out the sale of vehicles with traditional internal combustion engines in that state by 2035 — and may use the zero-emission vehicle program as the tool to achieve that goal — but the Wolf administration has no plans to follow suit.

The draft rule under consideration in Pennsylvania would adopt the California vehicle program’s current requirements only; any changes California makes to the program would not be adopted in Pennsylvania unless the Commonwealth goes through a separate rule-making process, Mr. Hammond said.

”There has been lot of misinformation floating around” claiming DEP plans to adopt a ban on new cars with internal combustion engines in 2035, he said. “We are not doing that. I like to speak bluntly: No IC engine ban. Absolutely not.”

But Pennsylvania’s timeline threatens to set up confusing compliance obligations for automakers, said Julia Rege, vice president for energy and environment at the Alliance for Automotive Innovation, a trade group that represents the makers of nearly all of the light-duty vehicles sold in the U.S.

States essentially have two options for adopting emissions rules for vehicles: meet the standards set by the federal government or sign on to California’s stricter standards. But by the time Pennsylvania plans to line up with California’s rules in 2025, she said, the Golden State will have set new standards for the year 2025 and beyond.

”In effect, Pennsylvania could be adopting a program that, by the time it’s implemented, no longer exists,” she said.

Hammond said Pennsylvania will evaluate the next stage of California’s rules once they are developed and evaluate whether or not to adopt those rules.

Robert Routh, an attorney for the Philadelphia-based Clean Air Council, said the current proposal is an important start.

”To avoid the worst impacts of the climate crisis, we will need to do more than simply change motors in the vehicles we drive,” he said, “but it is nonetheless still critical that Pennsylvania join states across the country in stepping up to make clean cars both cheaper and easier to find.”

Pennsylvania’s Climate Action Plan, which was released last month, found that increasing adoption of light-duty electric vehicles could cut greenhouse gas emissions by 23.8 million metric tons of carbon dioxide in 2050 compared to business as usual — making it one of the most effective strategies for slashing emissions in the plan.

Those estimates were based on electric vehicles representing 20% of light-duty vehicle sales by 2030 and 70% by 2050. Meeting that mark would require a capital expenditure of $4.8 billion, the plan said.

The positive economic impacts of such a transition to electric vehicles would outweigh the negatives, according to the climate plan: In 2050, Pa. consumers would be expected to save $2.7 billion on fuel costs and $1.3 billion on vehicle maintenance and repair.

The savings for avoided health impacts from reducing tailpipe pollution could be greater than $2 billion in 2050, according to an American Lung Association study.

Apple supplier Foxconn may launch first electric vehicle on Oct 18

Apple supplier and the world’s biggest contract electronics manufacturer Foxconn, the world’s largest contract electronics producer is reportedly planning to unveil its first electric vehicle ‘FOXTRON’ in a few days’ time – precisely on October 18.

According to couple of teasers released by Original Device Manufacturer (ODM), the front view of the new car has the name “FOXTRON” inscribed, suggesting that will be the name of the car brand. The car is a sedan incorporating sports car elements into the body shape in the style of a four-door coupe, reports GizmoChina.

The company is said to be planning to unveil not just one EV but three electric cars.

As per the report, the vehicle will also support remote updates and different levels of automatic driving assistance functions.

FOXTRON is expected to come with battery packs capacities of 93Wh, 100Wh, and 116kWh. The output power of the front motor of the model built will be 95kW, 150kW and 200kW, and the output power of the rear motor may be 150kW, 200kW, 240kW and 340kW.

Foxconn recently said it will build electric vehicle manufacturing facilities in the US and Thailand next year.

According to Nikkei Asia, Thailand plant will be part of Foxconn’s joint venture with Thai oil and gas conglomerate PTT to develop a platform for EV and component production.

Meanwhile, the US plant will serve clients such as American EV startup Fisker, for which the Taiwanese company will begin building EVs by the end of 2023.

–IANS

wh/ksk/

(Only the headline and picture of this report may have been reworked by the Business Standard staff; the rest of the content is auto-generated from a syndicated feed.)

Dear Reader,

Dear Reader,

Business Standard has always strived hard to provide up-to-date information and commentary on developments that are of interest to you and have wider political and economic implications for the country and the world. Your encouragement and constant feedback on how to improve our offering have only made our resolve and commitment to these ideals stronger. Even during these difficult times arising out of Covid-19, we continue to remain committed to keeping you informed and updated with credible news, authoritative views and incisive commentary on topical issues of relevance.

We, however, have a request.

As we battle the economic impact of the pandemic, we need your support even more, so that we can continue to offer you more quality content. Our subscription model has seen an encouraging response from many of you, who have subscribed to our online content. More subscription to our online content can only help us achieve the goals of offering you even better and more relevant content. We believe in free, fair and credible journalism. Your support through more subscriptions can help us practise the journalism to which we are committed.

Support quality journalism and subscribe to Business Standard.

Digital Editor

New Survey Finds Electric Vehicle Drivers Prefer Charging To Gassing Up

What’s it like to drive an electric vehicle? To paraphrase an old ad campaign, ask a person who owns one. NewMotion, a European charging network owned by oil giant Shell, has released its latest annual survey of EV drivers, and the findings should make interesting reading for anyone thinking of buying an EV (or for companies looking to sell EV-related products).

The 2021 NewMotion EV Driver Survey (via The Next Web) asked 10,000 drivers from Germany, the Netherlands, France, the UK, and Belgium about their driving and charging habits.

What was the main reason they went electric? Conventional wisdom is that most car buyers don’t care about the polar bears, and that it’s the better performance and greater convenience of EVs that close sales. In the European market at least, this isn’t necessarily the case — nearly 60% of NewMotion’s respondents said the environmental impact was their main reason for buying an EV. [Editor’s note: years of CleanTechnica EV driver surveys have found the same, or actually higher percentages.] Of course, these are early adopters, and the remaining 40% that bought based on performance, coolness, or cost savings is still a large number, so it’s probably wise for automakers to continue appealing to buyers’ baser instincts.

Where do people charge? At home, at work and in public, in that order. Some 68% of respondents own a home charging station, and 38% have access to workplace charging. However, a substantial 15% said they have neither option, and must rely on public charging.

The most popular location for public charging was on-street charging, chosen by 62% of respondents as their preferred place to top up. Some 46% said they like to charge at parking garages, shopping centers, and leisure destinations.

A look at some of the charging products and services provided by NewMotion (YouTube: NewMotion)

Network interoperability is a hot topic these days — many drivers complain about the hassle of having to use multiple charging networks, with separate access cards and separate billing. NewMotion’s survey indicates that the majority of drivers find it necessary to sign up for more than one network — 94% said they carry at least one network’s card, and 74% have more than two. (NewMotion doesn’t appear to have asked whether drivers consider this a major inconvenience or not.)

Perhaps the most important question for prospective EV buyers: how many EV owners would consider going back to gas? Over 60% of respondents said their next car would be a battery-electric vehicle (the top five brands they crave are Tesla, Nissan, Renault, Hyundai, and Volkswagen). About 20% said they would consider a plug-in hybrid. A mere 4% would even think about going back to a legacy gas- or diesel-burner.

What do NewMotion’s respondents consider the most pressing improvements to the EV experience? What would encourage more of our unfortunate fellow car owners to join the electric fold? The top answers: more range; more and faster public charging; and lower purchase costs.

Those answers certainly come as no surprise, but here’s an interesting finding that many of us probably haven’t considered: 95% of respondents said that going electric has changed their driving behavior. Nearly half said they tend to drive more efficiently, slowing down and avoiding sudden starts in order to maximize range. However, a substantial 23% of drivers are doing the opposite — they’re loving the leaping instant torque of electric driving, and find themselves accelerating more aggressively than they used to. It’s fun leaving those poor gas burners behind at the traffic light, isn’t it?

Appreciate CleanTechnica’s originality? Consider becoming a CleanTechnica Member, Supporter, Technician, or Ambassador — or a patron on Patreon.

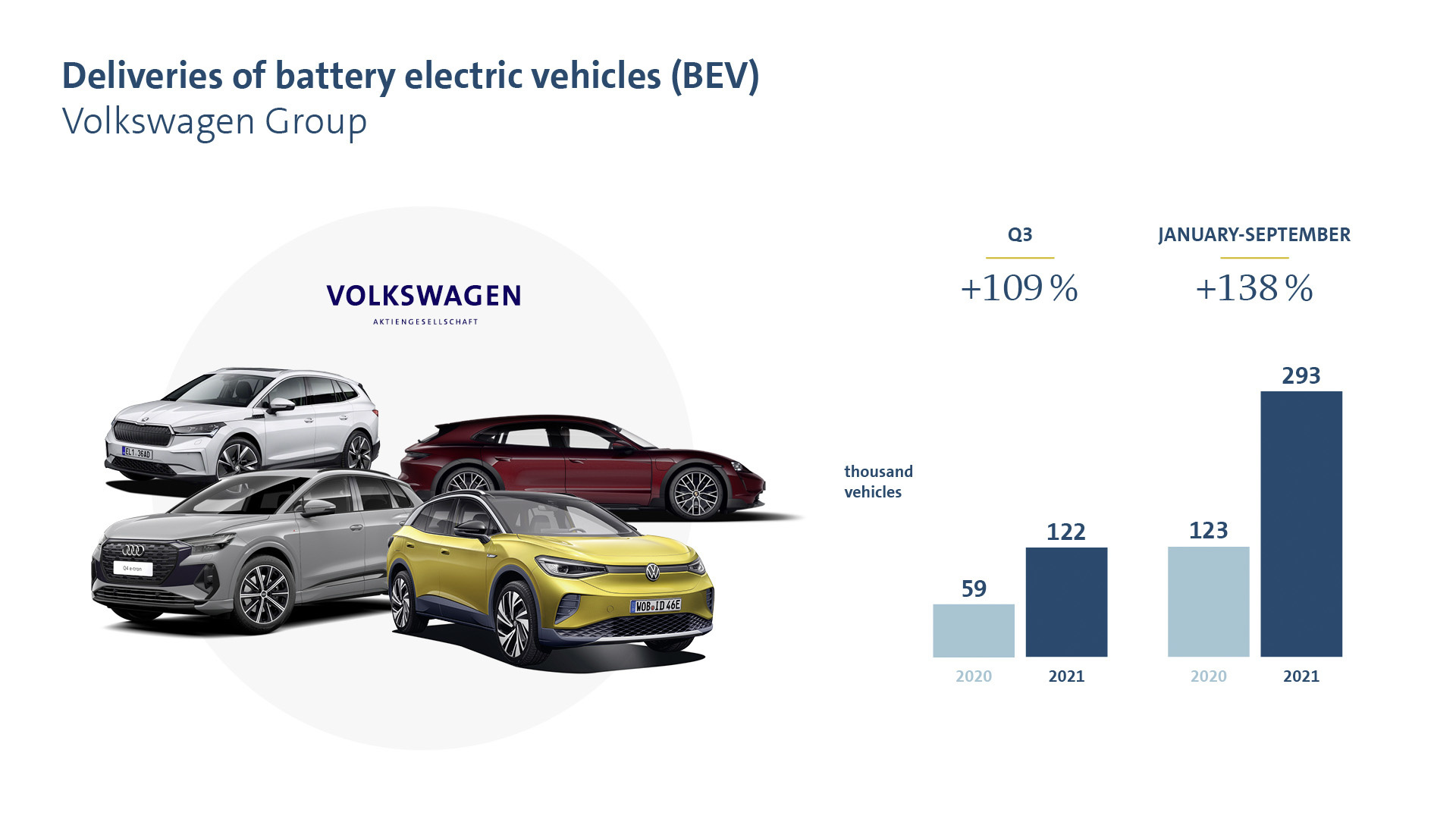

Volkswagen Group’s Electric Vehicle Sales Double In Q3 2021

The Volkswagen Group managed to sell 122,100 electric vehicles around the world between July and September of this year. That’s more than twice as many as it managed to sell in the same period in 2020.

“Our global electric offensive continues to run at full speed: we are clearly the number 1 for all-electric vehicles in Europe and the number 2 in the USA,” said Christian Dahlheim, head of group sales. “The strong demand for our global target for the year of one million electrified vehicles (BEVs+PHEVs) is definitely there.”

In China, meanwhile, sales are picking up quickly. In the first half of this year, the brand managed to sell 18,300 EVs, while it delivered 28,900 in Q3 alone. With sales surpassing 47,000 in the country so far this year, China accounts for 24 percent of all VW Group EV sales.

Read Also: VW Boss Says A Delay In Transition To EVs Could Cost 30,000 Jobs

“As planned, we significantly accelerated the BEV market ramp-up in China in the third quarter, and we are on track to meeting our target for the year of delivering 80,000 to 100,000 vehicles of the ID. model family,” said Dahlheim.

In all, the group has sold a total of 293,100 electric vehicles worldwide by the end of September, 47,000 more than it sold plug-in hybrids. In the first nine months of the year, EV sales are up 138 percent compared to the same period in 2020.

In terms of brands, Volkswagen leads the way with 57 percent of sales. Audi made up 18 percent of deliveries, while Skoda contributed 11 percent and Porsche just a little less with 10 percent.

The VW Group’s top five vehicles, in terms of sales, so far this year are the Volkswagen ID.4 (72,700 units), the ID.3 (52,700), the Audi e-tron and e-tron Sportback (36,100), the Porsche Taycan (28,600), and the Skoda Enyaq iV (28,200).

In all, EVs made up six percent of all Volkswagen Group sales in the third quarter of this year.

Pritzker’s electric-vehicle incentive plan deserves support: Editorial

The state’s most notable entry in this category is Rivian. At the company’s sole manufacturing plant in downstate Normal, electric pickup trucks are now rolling off the assembly line and being sold throughout the U.S., even as the company moves forward with plans to produce 100,000 electric delivery trucks to one of its key financial backers, Amazon.

Earlier this year, New York-based hydrogen vehicle maker Hyzon Motors said it will begin producing fuel cell components in Bolingbrook at what promises to be the largest plant of its kind in the U.S. Lion Electric, a Canadian maker of electric-powered school buses, plans a manufacturing plant in Joliet that will employ 800 people.

Meanwhile, Here Technologies, the digital mapping company that used to be known as Navteq, is developing GPS-enabled navigation devices with partners like BMW to make driverless cars a reality. And Argonne National Laboratory and the University of Illinois at Urbana-Champaign’s engineering school are working together on fuel cell development. Also, global delivery giant DHL is operating an innovation center here—one of just three worldwide—to explore how artificial intelligence can reshape the business of moving goods around.

So Illinois already has natural advantages in the race for 21st-century transportation investment. But, with Rivian eyeing Texas, not Illinois, for its second manufacturing plant, and with Ford Motor Co. recently announcing billions of dollars of electric-vehicle assembly investment in Tennessee and Kentucky—not at the Detroit giant’s existing mega-facility on Chicago’s Far South Side—warning signs are flashing that Illinois must do more to keep its edge in this rapidly growing field.

That’s why Pritzker must act swiftly to tout Illinois’ know-how now, while automotive giants like Ford and its rivals are pondering where to make these multibillion-dollar investments, decisions that will have major economic ripple effects for decades. And a smart centerpiece of Pritzker’s plan is to shore up the state’s existing automotive assembly centers—the Ford plant along Torrence Avenue and Stellantis’ similar facility at Belvidere just outside Rockford—to entice their owners to convert these factories to electric-vehicle production hubs of the future.

To pull that off, Pritzker’s plan offers a refundable state income tax credit of 75% or 100% of withholding from workers at electric manufacturing and supply plants, for up to 15 years. As Crain’s first explained, the larger, 100% figure would apply to newly hired workers at a facility located in an “underserved area” of the state. Belvidere, the South Side Ford plant, and Normal, Crain’s Hinz notes, would all qualify for that “underserved” designation.

Another focus of the legislation is luring Samsung, which is currently weighing bids from Illinois and Ohio to build an enormous battery factory that officials here want to land across the road from Rivian. That facility could employ as many as 7,500 people.

Automotive production has for decades been a pillar of the Midwest economy, even in Illinois, which may not boast as many assembly plants as other states, but which is home to a vast army of parts makers and suppliers. Shepherding these metal-benders toward the industry’s electric-powered future is a key economic development challenge for Illinois. One glance through the pages of Crain’s sister publication, Automotive News, the industry bible, confirms it: Headline after headline focuses on EV development. So Team Pritzker is correct to encourage a retooling of our existing manufacturing infrastructure, while also demonstrating to companies like Samsung that Illinois is the right place to invest.

What would be even better would be to address the other, more fundamental issues that have tended to make Illinois less attractive than other states: Our pension-weakened state finances and our well-earned reputation for political corruption, just for starters. That’s the long game. But in the meantime, if incentives can help us overcome those demerits, then the Legislature should get behind this plan.

Evergrande’s Swedish electric vehicle unit in sale talks, CEO says

The National Electric Vehicle Sweden (NEVS) logo is pictured on one of its electric cars at its Beijing headquarters building December 28, 2015. REUTERS/Kim Kyung-Hoon

STOCKHOLM, Oct 15 (Reuters) – The Swedish electric vehicle unit of China Evergrande Group (3333.HK) is in talks with U.S. and European venture capital firms and industrial partners to find new owners, its top chief said, as its Chinese parent battles default on more than $300 billion in debts.

National Electric Vehicle Sweden AB (NEVS), owned by the cash-strapped Chinese property developer, has funds to last “for a good while”, its Chief Executive Stefan Tilk said, adding that several investors were showing interest in the firm.

He declined to comment on a possible valuation. A source familiar with the situation told Reuters the unit could be valued at as much as $1 billion.

Evergrande has already missed three rounds of interest payments on its international bonds, and has been scrambling to sell some of its assets to raise cash. read more

The Chinese property developer has spent billions of dollars on stakes in automobile technology developers, including NEVS. It also has joint ventures with Germany’s Hofer and Sweden’s Koenigsegg.

NEVS, which received an electric vehicle production licence in China four years ago, is the Swedish arm of Evergrande’s EV unit Evergrande New Energy Vehicle Group (0708.HK).

Tilk said that NEVS is discussing a potential sale or other financing mainly with European and U.S. firms, but declined to name them.

“We are in dialogue both with venture people and companies that have the same idea and direction as us and want to get into this with our full competence,” he told Reuters. “So they are both industrial partners and venture capitalists.”

Evergrande NEV warned in stock exchange filings last month that it was still looking for new investors and to make asset sales, and that without either it may struggle to pay employee salaries and cover other expenses.

Tilk added that NEVS, which gave notice of redundancy to nearly half its roughly 650 workers in August, could hire staff again to get the competence Evergrande wants in Europe if it survives the crisis.

“If Evergrande can continue its operations, which they hope to do, they will be interested in having a footprint in Europe, with infrastructure like a plant, tests, lab. And we have that,” he said.

In the meantime NEVS, which bought carmaker Saab’s assets in 2012, is focusing on building its mobility ecosystem PONS, an autonomous ride-sharing network for smart cities and university campuses.

Reporting by Helena Soderpalm in Stockholm and Krystal Hu in New York; Editing by Sumeet Chatterjee and Jan Harvey

Our Standards: The Thomson Reuters Trust Principles.

GM, Ford Focus on EV Investment: Electric Vehicle Checkpoint

General Motors (GM) – Get General Motors Company (GM) Report is focusing on its electric vehicle investment.

EV revenues, GM said, will grow from around $10 billion currently to around $90 billion by the end of the decade, with a further $80 billion in “new, incremental revenue” from “connected vehicles and other new businesses.”

“GM has changed the world before and we’re doing it again,” said CEO Mary Barra. “We have multiple drivers of long-term growth and I’ve never been more confident or excited about the opportunities ahead.”

Action Alerts PLUS co-portfolio managers Bob Lang and Chris Versace broke down what they’re watching in the market, why investors should pay particular attention to the S&P 500, and talked about the future of EV. Want to get more of their investing insights and trading strategies? Check out a free trial of Action Alerts PLUS.

When asked if every investor needs an EV sector name in their portfolio at this point, Versace said: “Without a doubt, we’re going to see a pronounced structural shift towards the adoption of EVs. There’s an increasing number of consumers that are more mindful about the impact of emissions, there is regulatory reform pending that will help spur the adoption of those, and we’re seeing more companies enter the marketplace, which I think is good because it’s going to help drop the price of EVs and make them far more cost-competitive with existing fossil fuel-powered vehicles.”

“There is a pronounced structural shift so, at a minimum, I think members want some exposure. We can debate whether it’s Ford (F) – Get Ford Motor Company Report, GM, Tesla (TSLA,) – Get Tesla Inc Report or do we do it with a supplier?…I’ve mentioned one of my favorite investment strategies is to buy the bullets and not the guns, which really centers around key suppliers,” he added.

Right now, the AAP portfolio owns Ford and Versace touts the wonderfully-priced supply chain companies that will benefit from the uplift in EVs. “What GM said is extremely confirming about the structural shift…they’re putting some big numbers out there and we’ll see if those targets really stick, but it’s all in the right direction. A rising tide will lift all these boats.”

Tesla reportedly sent invitations to some drivers for its new experimental driver-assistance software, according to news reports.

The electric vehicle maker released a new version of its experimental driver-assistance software, Full Self-Driving Beta 10.2, CNBC reported citing an email the company sent to eligible car owners on Monday. To get access to FSD Beta in general, drivers must own Tesla vehicles with newer hardware and must purchase or subscribe to the premium FSD package, which costs $10,000 upfront in the U.S. or $199 a month.

The company used an insurance calculator to come up with a safety score for drivers. They must also score 100 out of 100 possible points in a week of driving at least 100 miles.

Tesla had delayed launching the software. CEO Elon Musk tweeted this past weekend that the company was delaying its release because of last-minute concerns about its build.

Tesla stock hit a seven-month high Tuesday after the carmaker defied a sharp slowdown in China to record its best-ever September sales tally from the world’s biggest car market. The company sold over 56,000 China-made cars in the month.

On Wednesday, Canadian acting legend William Shatner launched aboard a rocket and capsule developed by Blue Origin, the private spaceflight company founded by Amazon (AMZN) – Get Amazon.com, Inc. Report founder Jeff Bezos. Blue Origin is the rival to SpaceX, which is run by Tesla CEO Elon Musk.

Shatner and three other crew members — Audrey Powers, Blue Origin’s vice president of mission and flight operations, and two paying customers, Glen de Vries and Chris Boshuizen — took a trip on Blue Origin’s New Shepard rocket and capsule to the edge of space. Liftoff was at 10 a.m. ET from Blue Origin’s launch site in Van Horn, Texas. Shatner, 90, is now the oldest person to travel to space and back.

“Everybody in the world needs to do this,” Shatner said after the spaceflight, reported by CNN.

“William Shatner’s journey into space is much bigger than tourism for the ultra-wealthy but a symbol of the power of the human imagination,” Adam Frank, a professor of physics and astronomy at the University of Rochester, said Thursday. Frank told CNN that Shatner, an actor best known for his portrayal of Captain James T. Kirk on “Star Trek,” served as a symbol for humanity’s extraterrestrial hopes and dreams.

Blue Origin recently won a protective order in the U.S. Court of Federal Claims, sealing documents in its lawsuit against NASA, which alleges that the agency didn’t properly evaluate its proposal for the human landing system that it awarded to SpaceX.